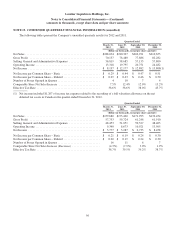

Lumber Liquidators 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

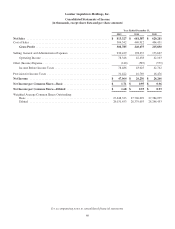

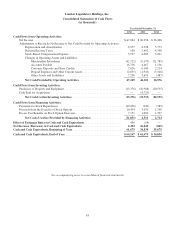

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

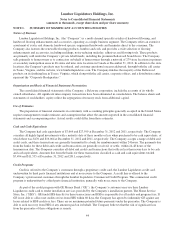

Recent Accounting Pronouncements

In September 2011, the FASB issued guidance that revises the requirements around how entities test goodwill for

impairment. The guidance allows companies to perform a qualitative assessment before calculating the fair value of the

reporting unit. If entities determine, on the basis of qualitative factors, that the fair value of the reporting unit is more likely

than not greater than the carrying amount, a quantitative calculation would not be needed. The Company adopted this

guidance for its fiscal 2012 annual goodwill impairment test.

NOTE 2. NOTES RECEIVABLE

As of December 31, 2012, the Company’s only notes receivable from a merchandise vendor had been fully reserved

with a $671 provision charge to SG&A expenses in the second quarter of 2012. As of December 31, 2011, the outstanding

balance due to the Company was $696, of which $322 had been included in other current assets.

NOTE 3. ACQUISITION

On September 28, 2011, the Company entered into an agreement to acquire certain assets of Sequoia Floorings Inc.

(“Sequoia”) relating to Sequoia’s quality control and assurance, product development, claims management and logistics

operations in China. The acquisition agreement included a purchase price of approximately $8,300, of which approximately

$4,700 was paid in cash. SG&A expenses in 2011 included acquisition-related expenses of approximately $600.

The purchase price for the acquisition was allocated to the assets acquired and liabilities assumed based upon their

respective fair values. The excess consideration was recorded as goodwill and approximated $8,643, of which all is

deductible for tax purposes.

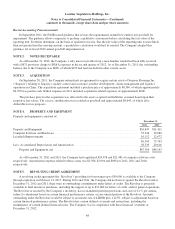

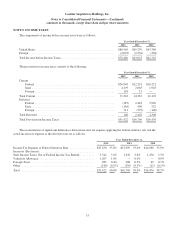

NOTE 4. PROPERTY AND EQUIPMENT

Property and equipment consisted of:

December 31,

2012 2011

Property and Equipment ................................................................ $36,847 $31,411

Computer Software and Hardware ........................................................ 33,344 29,680

Leasehold Improvements ............................................................... 16,112 12,672

86,303 73,763

Less: Accumulated Depreciation and Amortization .......................................... 38,539 29,616

Property and Equipment, net ........................................................ $47,764 $44,147

As of December 31, 2012 and 2011, the Company had capitalized $24,398 and $21,483 of computer software costs

respectively. Amortization expense related to these assets was $2,388, $2,094 and $896 for 2012, 2011 and 2010,

respectively.

NOTE 5. REVOLVING CREDIT AGREEMENT

A revolving credit agreement (the “Revolver”) providing for borrowings up to $50,000 is available to the Company

through expiration on February 21, 2017. During 2012 and 2011, the Company did not borrow against the Revolver and at

December 31, 2012 and 2011, there were no outstanding commitments under letters of credit. The Revolver is primarily

available to fund inventory purchases, including the support of up to $10,000 for letters of credit, and for general operations.

The Revolver is secured by the Company’s inventory, has no mandated payment provisions and a fee of 0.1% per annum,

subject to adjustment based on certain financial performance criteria, on any unused portion of the Revolver. Amounts

outstanding under the Revolver would be subject to an interest rate of LIBOR plus 1.125%, subject to adjustment based on

certain financial performance criteria. The Revolver has certain defined covenants and restrictions, including the

maintenance of certain defined financial ratios. The Company was in compliance with these financial covenants at

December 31, 2012.

48