Lumber Liquidators 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

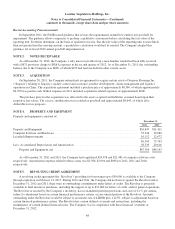

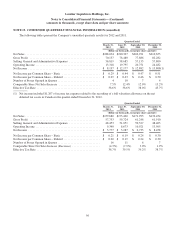

NOTE 6. LEASES

The Company has operating leases for its stores, Corporate Headquarters, supplemental office and distribution facilities

and certain equipment. The store location leases are operating leases and generally have five-year base periods with one or

more five-year renewal periods.

As of December 31, 2012, 2011 and 2010, the Company leased 27, 25 and 27 of its locations, representing 9.7%, 9.5%

and 12.1% of the total number of store leases in operation, respectively, and the Corporate Headquarters from entities

controlled by the Company’s founder (“Controlled Companies”). The Corporate Headquarters has an operating lease with a

base term running through December 31, 2019.

Rental expense is as follows:

Year Ended December 31,

2012 2011 2010

Rental expense .................................................... $18,826 $16,575 $13,784

Rental expense related to Controlled Companies ......................... 2,725 2,718 2,635

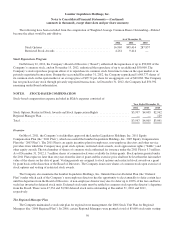

The future minimum rental payments under non-cancellable operating leases, segregating Controlled Companies leases

from all other operating leases, were as follows at December 31, 2012:

Operating Leases

Controlled Companies Store &

Other

Leases

Total

Operating

Leases

Store

Leases

Headquarters

Lease

2013 ................................................ $1,566 $1,163 $16,401 $19,130

2014 ................................................ 1,212 1,198 14,243 16,653

2015 ................................................ 953 1,234 12,139 14,326

2016 ................................................ 530 1,271 9,484 11,285

2017 ................................................ 229 1,309 5,813 7,351

Thereafter ........................................... 364 2,737 5,370 8,471

Total minimum lease payments ........................... $4,854 $8,912 $63,450 $77,216

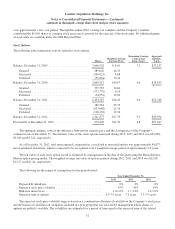

NOTE 7. STOCKHOLDERS’ EQUITY

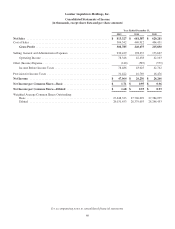

Net Income per Common Share

The following table sets forth the computation of basic and diluted net income per common share:

Year Ended December 31,

2012 2011 2010

Net Income ....................................................... $ 47,064 $ 26,256 $ 26,266

Weighted Average Common Shares Outstanding—Basic ................... 27,448,333 27,706,629 27,384,095

Effect of Dilutive Securities:

Common Stock Equivalents ...................................... 583,120 673,064 862,358

Weighted Average Common Shares Outstanding—Diluted ................. 28,031,453 28,379,693 28,246,453

Net Income per Common Share—Basic ................................ $ 1.71 $ 0.95 $ 0.96

Net Income per Common Share—Diluted ............................... $ 1.68 $ 0.93 $ 0.93

49