Logitech 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

disclosures associated with any recorded income tax uncertainties. FIN 48 is effective for fiscal years beginning

after December 15, 2006 and is required to be adopted by the Company in the first quarter of fiscal year 2008.

The cumulative effects, if any, of applying FIN 48 will be recorded as an adjustment to retained earnings as of

the beginning of the period of adoption. We are evaluating the financial statement and disclosure impact of

adopting FIN 48. In May 2007, the FASB issued FASB Staff Position FIN 48-1, “Definition of ‘Settlement’ in

FASB Interpretation No. 48” (“FSP FIN 48-1”). FSP FIN 48-1 provides guidance on how a company should

determine whether a tax position is effectively settled for the purpose of recognizing previously unrecognized tax

benefits. FSP FIN 48-1 is effective upon initial adoption of FIN 48, which we will adopt in the first quarter of

fiscal year 2008.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, “Fair Value

Measurements” (“SFAS 157”). SFAS 157 defines fair value, establishes a framework for measuring fair value

under generally accepted accounting principles, and expands disclosures about fair value measurements.

SFAS 157 affects other accounting pronouncements that require or permit fair value measurements where the

FASB has previously concluded that fair value is the relevant measurement attribute. SFAS 157 does not require

any new fair value measurements, but may change current practice in some instances. SFAS 157 is effective for

fiscal years beginning after November 15, 2007. We will adopt SFAS 157 in the first quarter of fiscal year 2009,

and we are evaluating the financial statement and disclosure impact.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities – including an amendment of FAS 115” (“SFAS 159”). SFAS 159 allows companies to

choose, at specified election dates, to measure eligible financial assets and liabilities at fair value that are not

otherwise required to be measured at fair value. Unrealized gains and losses shall be reported on items for which

the fair value option has been elected in earnings at each subsequent reporting date. SFAS 159 also establishes

presentation and disclosure requirements. SFAS 159 is effective for fiscal years beginning after November 15,

2007 and is required to be adopted by the Company in the first quarter of fiscal year 2009. SFAS 159 will be

applied prospectively. We are currently determining whether fair value accounting is appropriate for any of our

eligible items and cannot estimate the financial statement and disclosure impact which SFAS 159 would have, if

any.

Results of Operations

Year Ended March 31, 2007 Compared with Year Ended March 31, 2006

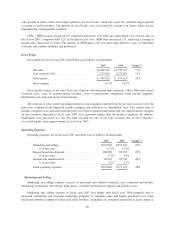

Net Sales

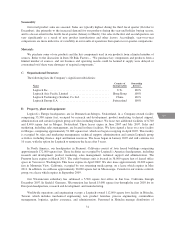

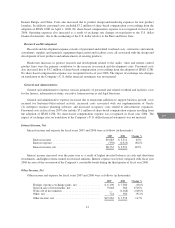

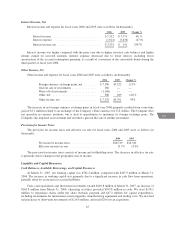

Net sales by channel and product family for fiscal years 2007 and 2006 were as follows (in thousands):

2007 2006 Change %

Net sales by channel:

Retail ................................ $1,844,395 $1,588,033 16%

OEM ................................ 222,174 208,682 6%

Total net sales ..................... $2,066,569 $1,796,715 15%

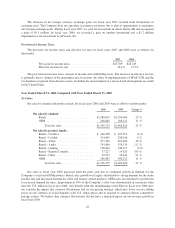

Net sales by product family:

Retail – Cordless ....................... $ 525,885 $ 448,358 17%

Retail – Corded ........................ 332,129 314,695 6%

Retail – Video ......................... 313,932 273,340 15%

Retail – Audio ......................... 404,069 334,496 21%

Retail – Gaming ....................... 145,784 136,944 6%

Retail – Remote Controls ................ 91,739 57,227 60%

Retail – Other ......................... 30,857 22,973 34%

OEM ................................ 222,174 208,682 6%

Total net sales ..................... $2,066,569 $1,796,715 15%

38