Logitech 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

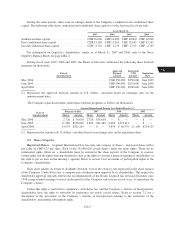

Company made no grants of restricted shares, stock appreciation rights or stock units under the 1996 Plan. No

further awards will be granted under the 1996 Plan.

1988 Stock Option Plan. Under the 1988 Stock Option Plan, options to purchase shares were granted to

employees and consultants at exercise prices ranging from zero to amounts in excess of the fair market value of

the shares on the date of grant. The terms and conditions with respect to options granted were determined by the

Board of Directors who administered this plan. Options generally vested over four years and remained

outstanding for periods not exceeding ten years. Further grants may not be made under this plan and as of

March 31, 2007, there were no options outstanding under this plan.

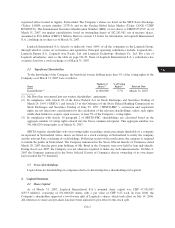

As of March 31, 2007, there were a total of 18,875,722 shares subject to outstanding options granted under

all plans. Each option entitles the holder to purchase one share of Logitech International S.A. at the exercise

price. Of these options, 10,436,970 were exercisable, with the balance subject to continued vesting over time.

The exercise prices of the currently outstanding options range from $1.00 to $29.99. Logitech shareholders do

not have preferential rights to subscribe to employee options.

Refer to section 5.6 below and Note 4 to the Consolidated Financial Statements for more information on the

Company’s outstanding stock options.

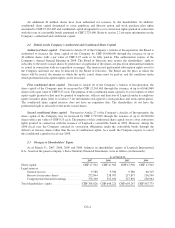

Employee Share Purchase Plans. Logitech maintains two employee share purchase plans, one for

employees in the United States and one for employees outside the United States. The plan for employees outside

the United States is named the 2006 Employee Share Purchase Plan (Non-U.S.) (“2006 ESPP”) and was

approved by the Board of Directors in June 2006. The plan for employees in the United States is named the 1996

Employee Share Purchase Plan (U.S.) (“1996 ESPP”). The 1996 ESPP was the worldwide plan until the adoption

of the 2006 ESPP in June 2006. Under both plans, eligible employees may purchase shares with up to 10% of

their earnings at the lower of 85% of the fair market value at the beginning or the end of each six-month offering

period. Purchases under the plans are limited to a fair value of $25,000 in any one year, calculated in accordance

with U.S. tax laws. There are two offering periods, each consisting of a six-month period during which payroll

deductions of employee participants are accumulated under the share purchase plan. Subject to continued

participation in these plans, purchase agreements are automatically executed at the end of each offering period. A

total of 12,000,000 shares have been reserved for issuance under both the 1996 and 2006 ESPP plans. As of

March 31, 2007, a total of 1,479,217 shares were available for issuance under these plans.

Although the Company has been authorized by its shareholders to use conditional capital to meet its

obligations to deliver shares as a result of employee purchases or exercises under the above plans, the Company

has for some years used shares held in treasury to fulfill its obligations under the plans.

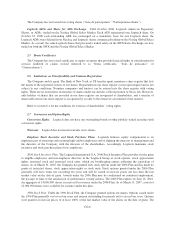

3. The Board of Directors

The Board of Directors is elected by the shareholders and holds the ultimate decision-making authority

within the Company, except for those matters reserved by law or by the Company’s Articles of Incorporation to

its shareholders or for those that are delegated to the Executive Officers under the Organizational Regulations.

The Board makes resolutions through a majority vote of the members present at the meetings. In the event of a

tie, the vote of the Chairman decides.

The Company’s Articles of Incorporation set the minimum number of directors at three. The Company had

eight Directors as of May 1, 2007.

3.1 Members of the Board

Gary F. Bengier, U.S. national, has been a non-executive Director of the Company since June 2002 and is

Lead Independent Director. In addition to serving on Logitech’s board, Mr. Bengier also serves on the Board of

CG-7

20-F

LISA