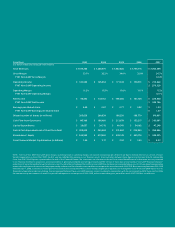

Logitech 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MILLIONS $ NET SALES

2,100

1,900

1,700

1,500

1,300

1,100

900

700

500

300

2,067

+15%

1,483

+17%

1,268

+15%

1,100

+17%

944

+28%

736

+24%

Logitech

PC Industry

Mobile Phone Industry

(Top 6)

SALES GROWTH

50%

40%

30%

20%

10%

0%

-10%

-20%

592

+32%

1,797

+21%

Source: Company reports

Ninth Consecutive Year of Double-Digit Growth in Sales

with Accelerating Profi t Growth*

Fiscal Year 2007 was the best in our history. At the start

of the year we set a goal to improve our profi tability and

we did, with our best gross, operating and net margins

ever. We also targeted an improvement in our cash fl ow

from operations and we doubled last year’s total.

In FY 2007 we exceeded $2 billion in sales for the fi rst

time in our history, with sales up by 15 percent year over

year to $2.07 billion. Net income grew by 35 percent to

a record high of $245 million. We also posted our 34th

consecutive quarter of double-digit sales growth, a streak

that began in December 1998. While sales in the PC in-

dustry grew by only 5 percent year over year in CY 2006,

the 16 percent growth of our retail sales (89 percent of

our FY 2007 sales) demonstrated once again that our

business is largely decoupled from PC industry growth

trends. We were able to grow our retail sales in the

Americas by 18 percent in FY 2007 despite widespread

concerns about the health of U.S. consumer spending. We

believe that the uniqueness of our business model, which

features consistently innovative retail offerings at very

affordable price points combined with wide distribution

and strong brand presence, has been a major factor in

our continued success.

A key driver in both our recent performance as well as

our outlook for continued growth is our ability to take

advantage of the opportunities related to four megatrends:

1.) Wireless Connectivity

Logitech has long been the leader in cordless mice and

keyboards. We estimate cordless penetration in the PC

installed base remains low at just 22 percent, providing

us with a signifi cant opportunity for continued growth.

Consumer interest in wireless devices has never been

greater and goes well beyond the desktop PC. Our

extensive experience in radio-frequency technology has

allowed us to expand our wireless offerings to game

controllers, headphones for the iPod® and, most recently,

wireless music distribution in the home.

2.) Internet Communication

The rapid adoption of broadband continued in FY 2007

as the number of broadband users grew to more than

290 million. The higher data-transmission speeds enable

and enhance communication applications such as Windows

Live™ Messenger and Skype™

. As an indication of the popu-

larity of these applications, there were more than

11 billion cumulative video sessions conducted on Windows

Live through January 2007. The combination of the

growing popularity of Internet communications, our

market-leading position in webcams and our competitive

strengths in PC audio peripherals leaves us uniquely

positioned to ride the wave of future growth.

3.) Digital Music

Digital music is everywhere, on the PC, on the iPod

and streamed wirelessly throughout the home. We’re

addressing the growing demand for end-to-end solutions

for digital music in the home by offering speakers for

listening to music on the PC and an expanded portfolio

of iPod speakers and headphones. Most recently we

strengthened our position in the emerging wireless music

category with our acquisition of Slim Devices.

* FY 2007 gross margin, operating expenses, operating income, operating margin, net income, tax rate, net margin and EPS are non-GAAP measures that exclude the costs of share-based compensation.

A reconciliation between GAAP and non-GAAP measures is provided at the end of this document.

FY 00 01 02 03 04 05 06 07 FY 00 01 02 03 04 05 06 07