Logitech 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

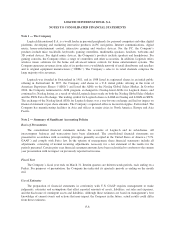

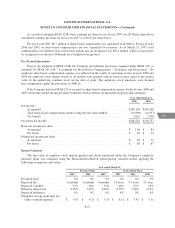

Impairment of Long-Lived Assets

The Company reviews long-lived assets, such as investments, property and equipment, and intangible assets,

for impairment whenever events indicate that the carrying amounts might not be recoverable. Recoverability of

investments, property and equipment, and other intangible assets is measured by comparing the projected

undiscounted net cash flows associated with those assets to their carrying values. If an asset is considered

impaired, it is written down to fair value, which is determined based on the asset’s projected discounted cash

flows or appraised value, depending on the nature of the asset. Goodwill is evaluated for impairment at least

annually.

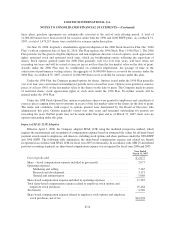

Income Taxes

The Company provides for income taxes using the liability method, which requires that deferred tax assets

and liabilities be recognized for the expected future tax consequences of temporary differences resulting from

differing treatment of items for tax and accounting purposes. In estimating future tax consequences, expected

future events are taken into consideration, with the exception of potential tax law or tax rate changes.

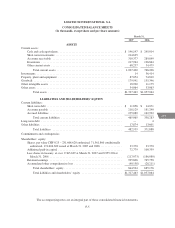

Fair Value of Financial Instruments

The carrying value of certain of the Company’s financial instruments, including cash, cash equivalents,

short-term investments, accounts receivable, accounts payable, short-term debt and current maturities of long-

term debt approximates fair value due to their short maturities. The estimated fair value of publicly traded

financial equity instruments are determined by quoted market prices.

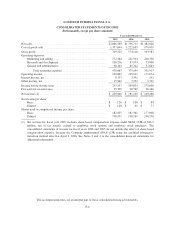

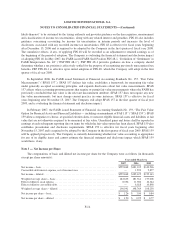

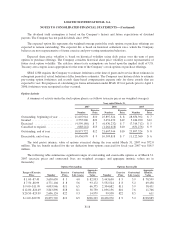

Net Income per Share

Basic net income per share is computed by dividing net income by the weighted average outstanding shares.

Diluted net income per share is computed using the weighted average outstanding shares and dilutive share

equivalents. Dilutive share equivalents consist of employee stock options and convertible debt.

The dilutive effect of in-the-money stock options is calculated based on the average share price for each

fiscal period using the treasury stock method, which assumes that the amount used to repurchase shares includes

the amount the employee must pay for exercising stock options, the amount of compensation cost not yet

recognized for future service, and the amount of tax benefits that would be recorded in additional paid-in capital

when the award becomes deductible. The dilutive effect of convertible debt is based upon conversion, computed

using the if-converted method.

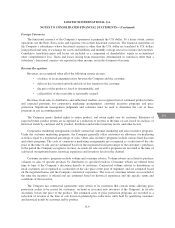

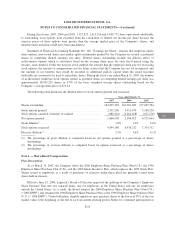

Share-Based Compensation Expense

The Company adopted the fair value recognition provisions of Statement of Financial Accounting Standards

No. 123 (revised 2004), “Share-Based Payments” (“SFAS 123R”), effective April 1, 2006, using the modified

prospective transition method. Therefore, results for periods prior to April 1, 2006 have not been restated to

include share-based compensation expense calculated in accordance with SFAS 123R. The Company recognized

share-based compensation expense in those periods in accordance with Accounting Principles Board Opinion

No. 25, “Accounting for Stock Issued to Employees” (“APB 25”). In March 2005, the Securities and Exchange

Commission (“SEC”) issued Staff Accounting Bulletin No. 107 (“SAB 107”) regarding the SEC’s interpretation

of SFAS 123R and the valuation of share-based payments for public companies. Logitech has applied the

provisions of SAB 107 in its adoption of SFAS 123R.

F-12