Logitech 2007 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

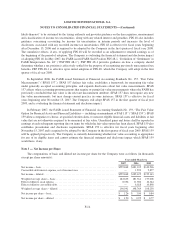

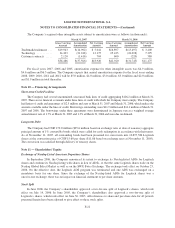

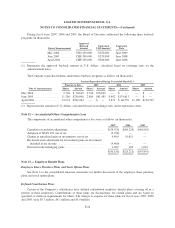

During fiscal years 2007, 2006 and 2005, 3,327,825, 1,615,556 and 4,039,772 share equivalents attributable

to outstanding stock options were excluded from the calculation of diluted net income per share because the

exercise prices of these options were greater than the average market price of the Company’s shares, and

therefore their inclusion would have been anti-dilutive.

Statement of Financial Accounting Standards No. 128, “Earnings per Share,” requires that employee equity

share options, non-vested shares and similar equity instruments granted by the Company are treated as potential

shares in computing diluted earnings per share. Diluted shares outstanding include the dilutive effect of

in-the-money options which is calculated based on the average share price for each fiscal period using the

treasury stock method. Under the treasury stock method, the amount that the employee must pay for exercising

stock options, the amount of compensation cost for future service that the Company has not yet recognized, and

the amount of tax benefits that would be recorded in additional paid-in capital when the award becomes

deductible are assumed to be used to repurchase shares. During the fiscal year ended March 31, 2007, the number

of in-the-money employee stock options treated as potential shares in computing diluted earnings per share was

approximately 18,035,229 shares or 9.9% of the basic weighted average shares outstanding based on the

Company’s average share price of $23.44.

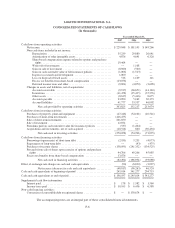

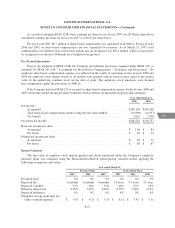

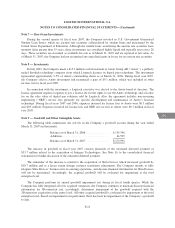

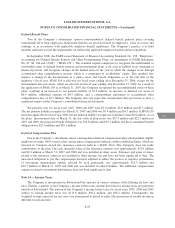

The following table illustrates the dilution effect of stock options granted and exercised:

Year ended March 31

2007 2006 2005

Shares outstanding ........................................ 182,635,345 181,361,200 177,007,784

Stock options granted ..................................... 2,555,200 3,451,470 5,186,920

Stock options canceled, forfeited, or expired ................... (688,242) (1,264,618) (631,276)

Net options granted ....................................... 1,866,958 2,186,852 4,555,644

Grant dilution(1) .......................................... 1.0% 1.2% 2.6%

Stock options exercised .................................... 4,599,180 6,476,232 7,314,712

Exercise dilution(2) ........................................ 2.5% 3.6% 4.1%

(1) The percentage of grant dilution is computed based on net options granted as a percentage of shares

outstanding.

(2) The percentage of exercise dilution is computed based on options exercised as a percentage of shares

outstanding.

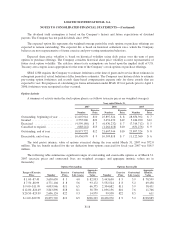

Note 4 — Share-Based Compensation

Plan Descriptions

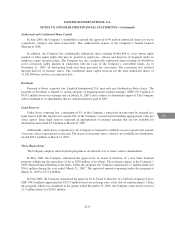

As of March 31, 2007, the Company offers the 2006 Employee Share Purchase Plan (Non-U.S.), the 1996

Employee Share Purchase Plan (U.S.), and the 2006 Stock Incentive Plan, which replaces the 1996 Stock Plan.

Shares issued to employees as a result of purchases or exercises under these plans are generally issued from

shares held in treasury.

Effective June 15, 2006, Logitech’s Board of Directors approved the splitting of the Company’s Employee

Share Purchase Plan into two separate plans, one for employees in the United States and one for employees

outside the United States. As a result, the Board adopted the 2006 Employee Share Purchase Plan (Non-U.S.)

(“2006 ESPP”) and renamed the 1996 Employee Share Purchase Plan as the 1996 Employee Share Purchase Plan

(U.S.) (“1996 ESPP”). Under both plans, eligible employees may purchase shares at the lower of 85% of the fair

market value at the beginning or the end of each six-month offering period. Subject to continued participation in

F-15

CG