Logitech 2007 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

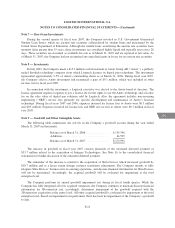

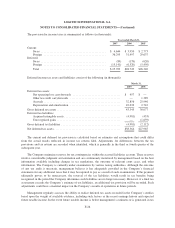

goods sold when the related inventory is sold. Realized net losses reclassified to cost of goods sold during fiscal

years 2007, 2006 and 2005 were $0.3 million, $2.6 million and $1.0 million.

The Company also enters into foreign exchange forward contracts to reduce the short-term effects of foreign

currency fluctuations on certain foreign currency receivables or payables. The gains or losses on the foreign

exchange forward contracts offset the transaction losses or gains on the foreign currency receivables or payables

recognized in earnings. The foreign exchange forward contracts are entered into on a monthly basis and generally

mature within one to three months. Further, the Company may enter into foreign exchange swap contracts to

extend the terms of its foreign exchange forward contracts. The notional amounts of foreign exchange forward

contracts outstanding at March 31, 2007 and 2006 were $9.0 million and $8.6 million. The notional amounts of

foreign exchange swap contracts outstanding at March 31, 2007 and 2006 were $11.5 million and $5.9 million.

Unrealized net losses on the contracts were immaterial at March 31, 2007.

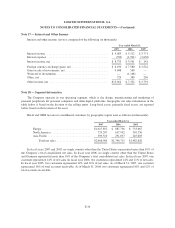

Note 16 — Commitments and Contingencies

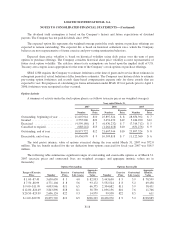

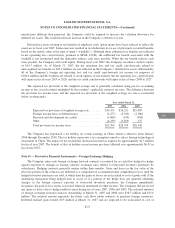

The Company leases facilities under operating leases, certain of which require it to pay property taxes,

insurance and maintenance costs. Operating leases for facilities are generally renewable at the Company’s option

and usually include escalation clauses linked to inflation. Future minimum annual rentals under non-cancelable

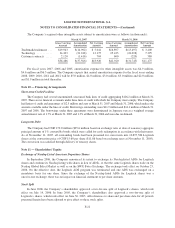

operating leases at March 31, 2007 are as follows (in thousands):

Year ending March 31,

2008 ......................................................... $12,060

2009 ......................................................... 11,117

2010 ......................................................... 9,305

2011 ......................................................... 7,865

2012 ......................................................... 7,294

Thereafter ..................................................... 15,237

$62,878

Rent expense was $9.9 million, $8.7 million and $7.0 million during the years ended March 31, 2007, 2006

and 2005.

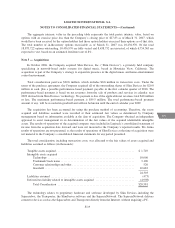

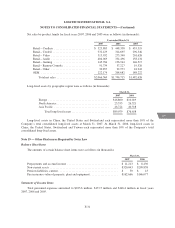

At March 31, 2007, fixed purchase commitments for capital expenditures amounted to $21.4 million, and

primarily related to commitments for manufacturing equipment, tooling and leasehold improvements. Also, the

Company has commitments for inventory purchases made in the normal course of business to original design

manufacturers, contract manufacturers and other suppliers. At March 31, 2007, fixed purchase commitments for

inventory amounted to $124.1 million, which are expected to be fulfilled within the fiscal quarter ending June 30,

2007. The Company also had other commitments totaling $28.3 million for consulting services, information

technology services, marketing arrangements and advertising. Although open purchase orders are considered

enforceable and legally binding, the terms generally allow the Company the option to reschedule and adjust its

requirements based on the business needs prior to delivery of goods or performance of services.

The Company has guaranteed the purchase obligations of some of its contract manufacturers to certain

component suppliers. These guarantees have a term of one year and are automatically extended for one or more

additional years as long as a liability exists. The amount of the purchase obligations of these manufacturers varies

over time, and therefore the amounts subject to Logitech’s guarantees similarly varies. At March 31, 2007, the

amount of these outstanding guaranteed purchase obligations was approximately $3.1 million. The Company

does not believe, based on historical experience and information currently available, that it is probable that any

amounts will be required to be paid under these guarantee arrangements.

F-28