Logitech 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

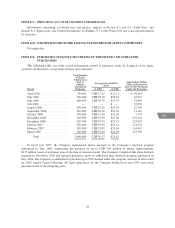

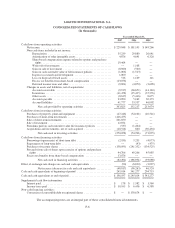

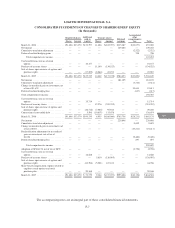

LOGITECH INTERNATIONAL S.A.

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(In thousands)

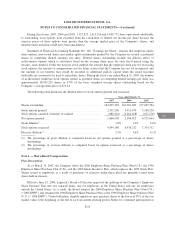

Registered shares Additional

paid-in

capital

Treasury shares Retained

earnings

Accumulated

other

comprehensive

loss TotalShares Amount Shares Amount

March 31, 2004 ....................... 191,606 $33,370 $132,797 11,606 $(102,397) $435,387 $(42,077) 457,080

Net income ........................... — — — — — 149,266 — 149,266

Cumulative translation adjustment ........ — — — — — — (2,522) (2,522)

Deferred realized hedging gains .......... — — — — — — 708 708

Total comprehensive income ......... 147,452

Tax benefit from exercise of stock

options ............................ — — 10,157 — — — — 10,157

Purchase of treasury shares .............. — — — 11,100 (134,525) — — (134,525)

Sale of shares upon exercise of options and

purchase rights ...................... — — (17,209) (8,064) 63,194 — — 45,985

March 31, 2005 ....................... 191,606 $33,370 $125,745 14,642 $(173,728) $584,653 $(43,891) $ 526,149

Net income ........................... — — — — — 181,105 — 181,105

Cumulative translation adjustment ........ — — — — — — (3,314) (3,314)

Change in unrealized gain on investment, net

of tax of $1,659 ..................... — — — — — — 19,611 19,611

Deferred realized hedging loss ........... — — — — — — (617) (617)

Total comprehensive income ............. 196,785

Tax benefit from exercise of stock

options ............................ — — 15,714 — — — — 15,714

Purchase of treasury shares .............. — — — 12,276 (241,352) — — (241,352)

Sale of shares upon exercise of options and

purchase rights ...................... — — (46,716) (7,066) 95,922 — — 49,206

Conversion of convertible debt ........... — — 5,596 (10,897) 133,078 — 138,674

March 31, 2006 ....................... 191,606 $33,370 $100,339 8,955 $(186,080) $765,758 $(28,211) $ 685,176

Net income ........................... — — — — 229,848 — 229,848

Cumulative translation adjustment ........ — — — — — — 9,695 9,695

Change in unrealized gain on investment, net

oftaxof$601....................... — — — — — — (10,211) (10,211)

Reclassification adjustment for net realized

gains on investment, net of tax of

$1,058 ............................ — — — — — — (9,400) (9,400)

Deferred realized hedging loss ........... — — — — — — 697 697

Total comprehensive income ......... 220,629

Adoption of SFAS 158, net of tax of $859 . . — — — — — — (2,728) (2,728)

Tax benefit from exercise of stock

options ............................ — — 14,668 — — — — 14,668

Purchase of treasury shares .............. — — — 5,610 (138,095) — — (138,095)

Sale of shares upon exercise of options and

purchase rights ...................... — — (62,396) (5,201) 107,102 — — 44,706

Share-based compensation expense related to

employee stock options and stock

purchase plan ....................... — — 20,168 — — — — 20,168

March 31, 2007 ....................... 191,606 $33,370 $ 72,779 9,364 $(217,073) $995,606 $(40,158) $ 844,524

The accompanying notes are an integral part of these consolidated financial statements.

F-7

CG

—