Logitech 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Withholding Tax

Under Swiss law, any dividends paid in respect of shares will be subject to the Swiss Anticipatory Tax at the

rate of 35%, and the Company will be required to withhold tax at this rate from any dividends paid to a holder of

registered shares. Such dividend payments may qualify for refund of the Swiss Anticipatory Tax by reason of the

provisions of a double tax treaty between Switzerland and the country of residence or incorporation of a holder,

and in such cases such holder will be entitled to claim a refund of all or a portion of such tax in accordance with

such treaty.

The Swiss-U.S. tax treaty provides for a mechanism whereby a United States resident or United States

corporations can generally seek a refund of the Swiss Anticipatory Tax paid on dividends in respect of registered

shares, to the extent such withholding exceeds 15%.

F. Dividends and Paying Agents

Not applicable.

G. Statement by Experts

Not applicable.

H. Documents on Display

Whenever a reference is made in this Form 20-F to any contract, agreement or other document, the reference

may not be complete and you should refer to the copy of that contract, agreement or other document filed as an

exhibit to one of our previous SEC filings. We file annual and special reports and other information with the

SEC. You may read and copy all or any portion of this Form 20-F and any other document we file with the SEC

at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330 for further information about the public reference room. Such material may also be obtained at

the Internet site the SEC maintains at www.sec.gov.

I. Subsidiary Information

Not applicable.

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market Risk

Market risk represents the potential for loss due to adverse changes in the fair value of financial instruments.

As a global concern, the Company faces exposure to adverse movements in foreign currency exchange rates and

interest rates. These exposures may change over time as business practices evolve and could have a material

adverse impact on the Company’s financial results.

Foreign Currency Exchange Rates

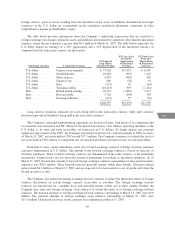

The Company is exposed to foreign currency exchange rate risk as it transacts business in multiple foreign

currencies, including exposure related to anticipated sales, anticipated purchases and assets and liabilities

denominated in currencies other than the U.S. dollar. Logitech transacts business in over 30 currencies

worldwide, of which the most significant to operations are the Euro, Chinese yuan renminbi (“CNY”), British

pound sterling, Taiwanese dollar, Mexican peso, Japanese yen and Canadian dollar. With the exception of its

operating subsidiaries in China, which use the U.S. dollar as their functional currency, Logitech’s international

operations generally use the local currency of the country as their functional currency. Accordingly, unrealized

58