Logitech 2007 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

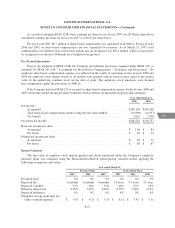

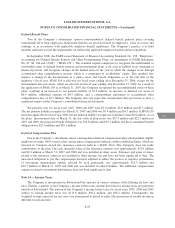

The aggregate intrinsic value in the preceding table represents the total pretax intrinsic value, based on

options with an exercise price less than the Company’s closing price of $27.83 as of March 31, 2007, which

would have been received by the option holders had those option holders exercised their options as of that date.

The total number of in-the-money options exercisable as of March 31, 2007 was 10,436,970. Of the total

18,875,722 options outstanding, 10,436,970 are fully vested and 8,438,752 are unvested, of which 6,754,563 are

expected to vest, based on an estimated forfeiture rate of 8%.

Note 5 — Acquisitions

In October 2006, the Company acquired Slim Devices, Inc. (“Slim Devices”), a privately held company

specializing in network-based audio systems for digital music, based in Mountain View, California. The

acquisition is part of the Company’s strategy to expand its presence in the digital music and home-entertainment

control environment.

Total consideration paid was $20.6 million, which includes $0.6 million in transaction costs. Under the

terms of the purchase agreement, the Company acquired all of the outstanding shares of Slim Devices for $20.0

million in cash, plus a possible performance-based payment, payable in the first calendar quarter of 2010. The

performance-based payment is based on net revenues from the sale of products and services in calendar year

2009 derived from Slim Devices’ technology. No payment is due if the applicable net revenues total $40 million

or less. The maximum performance-based payment is $89.5 million. The total performance-based payment

amount, if any, will be recorded in goodwill and will not be known until the end of calendar year 2009.

The acquisition has been accounted for using the purchase method of accounting. Therefore, the assets

acquired and liabilities assumed were recorded at their estimated fair values as determined by Company

management based on information available at the date of acquisition. The Company obtained an independent

appraisal to assist management in its determination of the fair values of the acquired identifiable intangible

assets. The results of operations of the acquired company were included in Logitech’s consolidated statement of

income from the acquisition date forward, and were not material to the Company’s reported results. Pro forma

results of operations are not presented, as the results of operations of Slim Devices at the time of acquisition were

not material to the Company’s consolidated financial statements for any period presented.

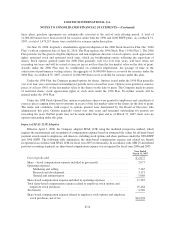

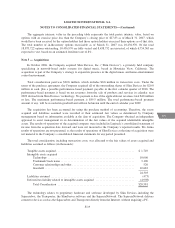

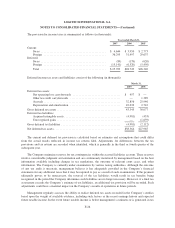

The total consideration, including transaction costs, was allocated to the fair values of assets acquired and

liabilities assumed as follows (in thousands):

Tangible assets acquired ...................................................... $ 1,749

Intangible assets acquired

Technology ............................................................ 10,000

Trademark/ trade name ................................................... 3,100

Customer relationships and other ........................................... 520

Goodwill .............................................................. 10,683

24,303

Liabilities assumed .......................................................... (473)

Deferred tax liability related to intangible assets acquired ........................... (4,998)

Total Consideration ..................................................... $20,581

The technology relates to proprietary hardware and software developed by Slim Devices including the

Squeezebox, the Transporter, the SlimServer software and the SqueezeNetwork. The SqueezeNetwork delivers

content to devices such as the Squeezebox and Transporter directly from the Internet, without requiring a PC.

F-19

CG