Logitech 2007 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

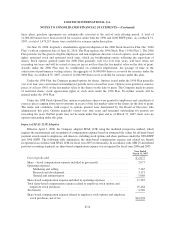

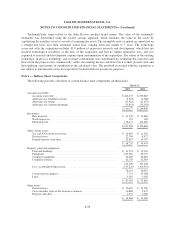

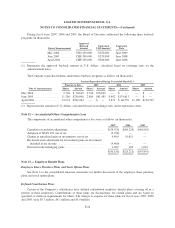

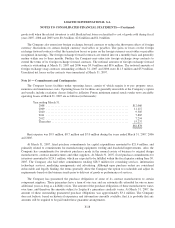

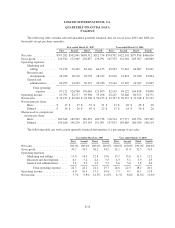

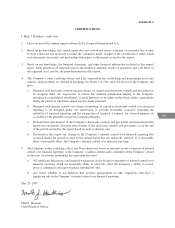

The provision for income taxes is summarized as follows (in thousands):

Year ended March 31,

2007 2006 2005

Current:

Swiss ............................................. $ 4,644 $ 3,950 $ 2,773

Foreign ........................................... 36,295 31,497 29,637

Deferred:

Swiss ............................................. (89) (178) (620)

Foreign ........................................... (15,141) (6,520) (5,450)

Total ............................................. $25,709 $28,749 $26,340

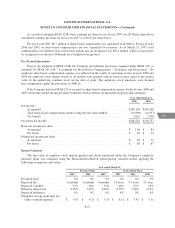

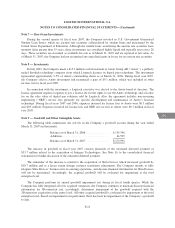

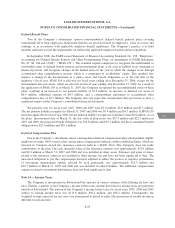

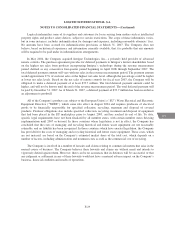

Deferred income tax assets and liabilities consist of the following (in thousands):

March 31,

2007 2006

Deferred tax assets:

Net operating loss carryforwards ................................. $ 457 $ —

Other tax credit carryforwards ................................... — 1,389

Accruals ..................................................... 32,856 25,946

Depreciation and amortization ................................... 10,032 2,742

Gross deferred tax assets ............................................ 43,345 30,077

Deferred tax liabilities:

Acquired intangible assets ....................................... (4,981) (453)

Unrecognized gains ............................................ — (1,659)

Gross deferred tax liabilities ......................................... (4,981) (2,112)

Net deferred tax assets .............................................. $38,364 $27,965

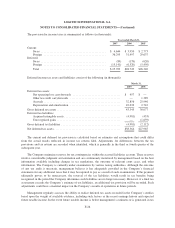

The current and deferred tax provision is calculated based on estimates and assumptions that could differ

from the actual results reflected in income tax returns filed. Adjustments for differences between the tax

provisions and tax returns are recorded when identified, which is generally in the third or fourth quarter of the

subsequent year.

The Company maintains reserves for tax contingencies within the accrued liabilities account. These reserves

involve considerable judgment and estimation and are continuously monitored by management based on the best

information available including changes in tax regulations, the outcome of relevant court cases, and other

information. The Company is currently under examination by various taxing authorities. Although the outcome

of any tax audit is uncertain, management believes it has adequately provided in the Company’s financial

statements for any additional taxes that it may be required to pay as a result of such examinations. If the payment

ultimately proves to be unnecessary, the reversal of the tax liabilities would result in tax benefits being

recognized in the period the Company determines such liabilities are no longer necessary. However, if a final tax

assessment exceeds the Company’s estimate of tax liabilities, an additional tax provision will be recorded. Such

adjustments could have a material impact on the Company’s results of operations in future periods.

Management regularly assesses the ability to realize deferred tax assets recorded in the Company’s entities

based upon the weight of available evidence, including such factors as the recent earnings history and expected

future taxable income. In the event future taxable income is below management’s estimates or is generated in tax

F-26