Logitech 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In May 2004, we acquired Intrigue Technologies, Inc., a privately held provider of advanced remote

controls. The purchase agreement provides for deferred payments to Intrigue’s former shareholders based on the

highest net sales from products incorporating Intrigue’s technology during the revenue measurement period,

defined as any consecutive four-quarter period beginning in April 2006 through September 2007. The total

deferred payment amount will vary with net sales in the revenue measurement period. The payment amount

would approximate 27% of such net sales at the highest net sales level, although the percentage could be higher

at lower net sales levels. Based on the net sales of remote controls for fiscal year 2007, the Company will be

obligated to make a deferred payment of at least $33.7 million. The total deferred payment amount could be

higher, and will not be known until the end of the revenue measurement period. The total deferred payment will

be paid by December 31, 2007. As of March 31, 2007, a deferred payment of $33.7 million has been recorded as

an adjustment to goodwill.

The Company believes that its cash and cash equivalents, cash flow generated from operations, and

available borrowings under its bank lines of credit will be sufficient to fund capital expenditures and working

capital needs for the foreseeable future.

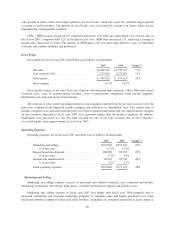

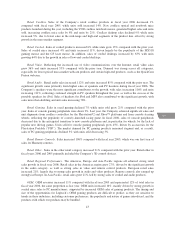

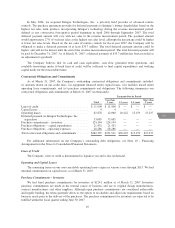

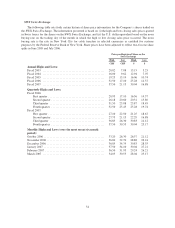

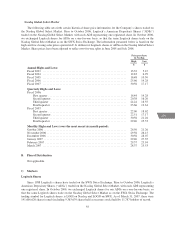

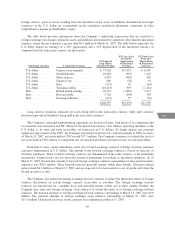

Contractual Obligations and Commitments

As of March 31, 2007, the Company’s outstanding contractual obligations and commitments included:

(i) amounts drawn on our credit lines, (ii) equipment financed under capital leases, (iii) facilities leased under

operating lease commitments, and (iv) purchase commitments and obligations. The following summarizes our

contractual obligations and commitments at March 31, 2007 (in thousands):

Payments Due by Period

Total

Less than

1 year 1-3 years 3-5 years

More than

5 years

Lines of credit .................................. $ 11,900 $ 11,900 $ — $ — $ —

Capital leases .................................. 4 4 — — —

Operating leases ................................ 62,878 12,060 20,422 15,159 15,237

Deferred payment on Intrigue Technologies, Inc.

acquisition ................................... 33,685 33,685 — — —

Purchase commitments – inventory ................. 124,144 124,144 — — —

Purchase obligations – capital expenditures ........... 21,432 21,432 — — —

Purchase obligations – operating expenses ............ 28,286 28,286 — — —

Total contractual obligations and commitments ........ $282,329 $2 1,511 $20,422 $15,159 $15,237

For additional information on the Company’s outstanding debt obligations, see Note 10 – Financing

Arrangements in the Notes to Consolidated Financial Statements.

Lines of Credit

The Company’s line of credit is denominated in Japanese yen and is due on demand.

Operating and Capital Leases

The remaining terms on our non-cancelable operating leases expire in various years through 2015. We had

minimal commitments on capital leases as of March 31, 2007.

Purchase Commitments – Inventory

We had fixed purchase commitments for inventory of $124.1 million as of March 31, 2007. Inventory

purchase commitments are made in the normal course of business and are to original design manufacturers,

contract manufacturers and other suppliers. Although open purchase commitments are considered enforceable

and legally binding, the terms generally allow us the option to reschedule and adjust our requirements based on

business needs prior to the delivery of the purchases. The purchase commitments for inventory are expected to be

fulfilled within the fiscal quarter ending June 30, 2007.

49

CG

3