Logitech 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During 2007, stock option grants to Executive Officers and other employees were made during regularly

scheduled Compensation Committee meetings or through actions taken by the Compensation Committee by

written consent between the dates of meetings according to a pre-determined schedule. The exercise prices of

options granted during the fiscal year were based on the closing trading price of our shares on the SWX Swiss

Exchange or the Nasdaq Global Select Market on the date of grant.

Employee Share Purchase Plans. Executive Officers are also eligible to participate in the Company’s

Employee Share Purchase Plans, under which employees may purchase shares with up to 10% of their earnings

at the lower of 85% of the fair market value at the beginning or the end of each offering period. Purchases under

the plans are limited to a fair value of $25,000 in any one year, calculated in accordance with U.S. tax laws.

There are two offering periods, each consisting of a six-month period during which payroll deductions of

employee participants are accumulated under the share purchase plan.

Deferred Compensation Plan. Executive Officers based in the United States are also eligible to participate

in the Logitech Inc. Management Deferred Compensation Plan, which is an unfunded and unsecured plan that

allows employees of Logitech Inc. earning more than a threshold amount the opportunity to defer U.S. taxes on

their base salary and bonus compensation. Logitech does not contribute to this plan. The Logitech Inc.

Management Deferred Compensation Plan is not intended to provide for the payment of above-market or

preferential earnings on compensation deferred under the plan. In fiscal year 2007 three Executive Officers

contributed to the plan. Four executives have balances in the plan based on contributions in the current and prior

fiscal years.

The Chief Executive Officer is not present at any deliberations or upon the vote of the Board to approve his

salary or equity compensation.

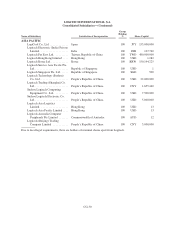

Non-Executive Director Compensation

The compensation of Logitech’s non-executive Directors is established by the Board Compensation

Committee (refer to section 3.5 above). The Board Compensation Committee reviews aggregate data on

non-executive Director compensation of comparable companies in setting compensation for Logitech’s

non-executive Directors.

Under the Company’s current policy, non-executive Directors are paid an annual retainer of $25,000, or

CHF 35,000 and receive $2,000, or CHF 2,500, for each board or committee meeting attended and also for each

day of travel to attend board or committee meetings. The Lead Independent Director receives a further retainer of

$10,000 per year. Annual service is measured between the dates of the Company’s Annual General Meetings.

The cash compensation is paid in arrears to each non-executive Board member after the Company’s Annual

General Meeting for their service on the Board in the prior year. All Directors are also reimbursed for business-

class travel and expenses in connection with attendance at Board and Committee meetings.

Each non-executive Director also receives options to purchase 30,000 of the Company’s shares upon their

election to the Board for a three-year term and options to purchase 15,000 shares upon their re-election to the

Board. These options are granted at the fair market value at the date of grant and become exercisable over three

years in equal annual installments.

Beginning with the 2007 Annual General Meeting the annual retainer for non-executive Board members

will increase to $30,000, or CHF 40,000, and the Chair of the Audit Committee will receive an additional retainer

of $12,000 or CHF 15,000. The additional retainer for the Lead Independent Director and the per meeting and

travel days compensation for non-executive Directors will remain the same.

Executive Directors do not receive any compensation for their service on the Board of Directors.

CG-20