Logitech 2007 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

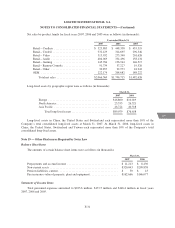

Defined Benefit Plans

Two of the Company’s subsidiaries sponsor noncontributory defined benefit pension plans covering

substantially all of their employees. Retirement benefits are provided based on employees’ years of service and

earnings, or in accordance with applicable employee benefit regulations. The Company’s practice is to fund

amounts sufficient to meet the requirements set forth in the applicable employee benefit and tax regulations.

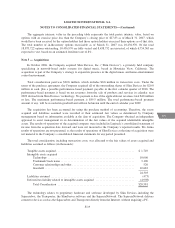

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 158, “Employers’

Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements

No. 87, 88, 106 and 132(R)” (“SFAS 158”). This standard requires employers to recognize the underfunded or

overfunded status of defined benefit pension and postretirement plans as an asset or liability in its statement of

financial position, and recognize changes in the funded status in the year in which the changes occur through

accumulated other comprehensive income, which is a component of stockholders’ equity. This standard also

requires a change in the measurement of a plan’s assets and benefit obligations as of the end date of the

employer’s fiscal year. SFAS 158 is effective for fiscal years ending after December 15, 2006, except for the

measurement date provisions, which are effective for fiscal years ending after December 15, 2008. As a result of

the application of SFAS 158 as of March 31, 2007, the Company recognized the net underfunded status of these

plans, resulting in an increase to net pension liability of $3.9 million, an increase to deferred tax assets of

$0.9 million, additional expense of $0.3 million, and a corresponding adjustment to accumulated other

comprehensive loss of $2.7 million. The Company does not expect the measurement date provisions to have a

significant impact on the Company’s consolidated financial statements.

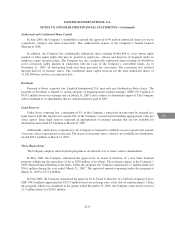

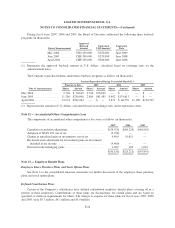

Net pension costs for fiscal years 2007, 2006 and 2005 were $3.0 million, $2.9 million and $3.3 million.

The net pension liability recognized at March 31, 2007 and 2006 was $7.4 million and $4.5 million. If SFAS 158

had been applicable for fiscal year 2006, the net pension liability recognized would have been $6.8 million. As of

the plans’ measurement date of March 31, the fair value of plan assets was $27.4 million and $22.3 million in

2007 and 2006, the projected benefit obligation was $34.8 million and $29.1 million and the accumulated benefit

obligation was $21.6 million and $20.1 million.

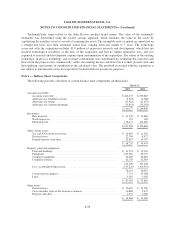

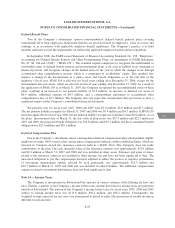

Deferred Compensation Plan

One of the Company’s subsidiaries offers a management deferred compensation plan which permits eligible

employees to make 100%-vested salary and incentive compensation deferrals within established limits, which are

invested in Company-owned life insurance contracts held in a Rabbi Trust. The Company does not make

contributions to the plan. The cash surrender value of the insurance contracts was approximately $10.9 million

and $9.4 million at March 31, 2007 and 2006 and was included in other assets. Expenses and gains or losses

related to the insurance contracts are included in other income, net and have not been significant to date. The

unsecured obligation to pay the compensation deferred, adjusted to reflect the positive or negative performance

of investment measurement options selected by each participant, was approximately $12.3 million and

$10.7 million at March 31, 2007 and 2006 and was included in other liabilities. The additional compensation

expenses related to investment performance have not been significant to date.

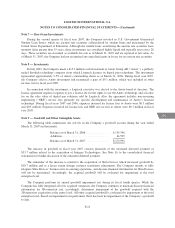

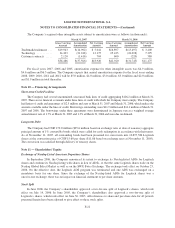

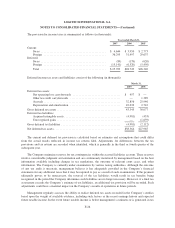

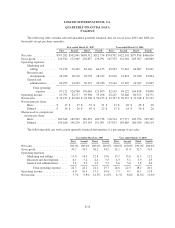

Note 14 — Income Taxes

The Company is incorporated in Switzerland but operates in various countries with differing tax laws and

rates. Further, a portion of the Company’s income before taxes and the provision for income taxes are generated

outside of Switzerland. The portion of the Company’s income before taxes for fiscal years 2007, 2006 and 2005

subject to foreign income taxes was $113.8 million, $92.2 million, and $58.2 million. Consequently, the

weighted average expected tax rate may vary from period to period to reflect the generation of taxable income in

different tax jurisdictions.

F-25

CG