JetBlue Airlines 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2012 10K82

PART IV

ITEM 15Exhibits and Financial Statement Schedules

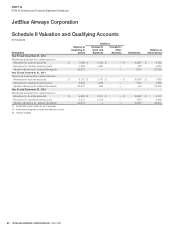

JetBlue Airways Corporation

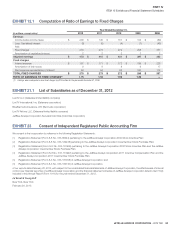

Schedule II Valuation and Qualifying Accounts

(in thousands)

Description

Balanceat

beginningof

period

Additions

Deductions Balanceat

endof period

Chargedto

Costs and

Expenses

Chargedto

Other

Accounts

Year Ended December31, 2012

Allowances deducted from asset accounts:

Allowance for doubtful accounts $ 7,586 $ 5,472 $ — $ 6,465(1) $ 6,593

Allowance for obsolete inventory parts 3,886 1,250 — 90(3) 5,046

Valuation allowance for deferred tax assets 20,872 — — 604(2) 20,268

Year Ended December31, 2011

Allowances deducted from asset accounts:

Allowance for doubtful accounts $ 6,172 $ 7,017 $ — $ 5,603(1) $ 7,586

Allowance for obsolete inventory parts 3,636 1,026 — 776(3) 3,886

Valuation allowance for deferred tax assets 20,672 254 — 54(2) 20,872

Year Ended December31, 2010

Allowances deducted from asset accounts:

Allowance for doubtful accounts $ 5,660 $ 7,471 $ — $ 6,959(1) $ 6,172

Allowance for obsolete inventory parts 3,373 1,018 — 755(3) 3,636

Valuation allowance for deferred tax assets 24,631 — — 3,959(2) 20,672

(1) Uncollectible accounts written off, net of recoveries.

(2) Attributable to recognition and write-off of deferred tax assets.

(3) Inventory scrapped.