JetBlue Airlines 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2012 10K50

PART II

ITEM 8Financial Statements and Supplementary Data

During 2011, we repurchased a total of $39 million principal amount of our Series A 6.75% Debentures for approximately $45 million. We recognized a loss of approximately $6 million on

these transactions, which is included in interest income and other on our consolidated statements of operation during 2011.

We evaluated the various embedded derivatives within the supplemental indenture for bifurcation from the 6.75% Debentures under the applicable provisions, including the basic conversion

feature, the fundamental change make-whole provision and the put and call options. Based upon our detailed assessment, we concluded these embedded derivatives were either

(i)excluded from bifurcation as a result of being clearly and closely related to the 6.75% Debentures or are indexed to our common stock and would be classified in stockholders’ equity if

freestanding or (ii)are immaterial embedded derivatives.

(6) On June4, 2008, we completed a public offering of $100.6 million aggregate principal amount of 5.5% Series A convertible debentures due 2038, or the Series A 5.5% Debentures, and

$100.6 million aggregate principal amount of 5.5% Series B convertible debentures due 2038, or the Series B 5.5% Debentures, and collectively with the Series A 5.5% Debentures, the

5.5% Debentures. The 5.5% Debentures are general senior obligations and were originally secured in part by an escrow account for each series. We deposited approximately $32 million

of the net proceeds from the offering, representing the first six scheduled semi-annual interest payments on the 5.5% Debentures, into escrow accounts for the exclusive benefit of the

holders of each series of the 5.5% Debentures. As of December31, 2011, all funds originally deposited in the escrow account had been used. Interest on the 5.5% Debentures is payable

semi-annually on April15 and October15.

Holders of the Series A 5.5% Debentures may convert them into shares of our common stock at any time at a conversion rate of 220.6288 shares per $1,000 principal amount of Series A

5.5% Debenture. Holders of the Series B 5.5% Debentures may convert them into shares of our common stock at any time at a conversion rate of 225.2252 shares per $1,000 principal

amount of Series B 5.5% Debenture. The conversion rates are subject to adjustment should we declare common stock dividends or effect any common stock splits or similar transactions.

If the holders convert the 5.5% Debentures in connection with any fundamental corporate change that occurs prior to October15, 2013 for the Series A 5.5% Debentures or October15,

2015 for the Series B 5.5% Debentures, the applicable conversion rate may be increased depending upon our then current common stock price. The maximum number of shares of

common stock into which all of the remaining 5.5% Debentures are convertible, including pursuant to this make-whole fundamental change provision, is 33.2 million shares. Holders who

converted their 5.5% Debentures prior to April15, 2011 received, in addition to the number of shares of our common stock calculated at the applicable conversion rate, a cash payment

from the escrow account for the 5.5% Debentures of the series converted equal to the sum of the remaining interest payments that would have been due on or before April15, 2011 in

respect of the converted 5.5% Debentures.

We may redeem any of the 5.5% Debentures for cash at a redemption price of 100% of their principal amount, plus accrued and unpaid interest at any time on or after October15, 2013

for the Series A 5.5% Debentures and October15, 2015 for the Series B 5.5% Debentures. Holders may require us to repurchase the 5.5% Debentures for cash at a repurchase price equal

to 100% of their principal amount plus accrued and unpaid interest, if any, on October15, 2013, 2018, 2023, 2028, and 2033 for the Series A 5.5% Debentures and October15, 2015,

2020, 2025, 2030, and 2035 for the Series B 5.5% Debentures; or at any time prior to their maturity upon the occurrence of a specified designated event.

On June4, 2008, in conjunction with the public offering of the 5.5% Debentures described above, we also entered into a share lending agreement with Morgan Stanley& Co. Incorporated,

an affiliate of the underwriter of the offering, or the share borrower, pursuant to which we loaned the share borrower approximately 44.9 million shares of our common stock. Under the

share lending agreement, the share borrower is required to return the borrowed shares when the debentures are no longer outstanding. We did not receive any proceeds from the sale of

the borrowed shares by the share borrower, but we did receive a nominal lending fee of $0.01 per share from the share borrower for the use of borrowed shares.

Our share lending agreement requires that the shares borrowed be returned upon the maturity of the related debt, October 2038, or earlier, if the debentures are no longer outstanding. We

determined the fair value of the share lending arrangement was approximately $5 million at the date of the issuance based on the value of the estimated fees the shares loaned would have

generated over the term of the share lending arrangement. The $5 million value was recognized as a debt issuance cost and is being amortized to interest expense through the earliest put

date of the related debt, October 2013 and October 2015 for Series A and Series B, respectively. As of December31, 2012, approximately $1 million of net debt issuance costs remain

outstanding related to the share lending arrangement and will continue to be amortized through the earliest put date of the related debt.

During 2008 and 2009, approximately $79 million principal amount of the 5.5% Debentures were voluntarily converted by holders. As a result, we issued 17.5 million shares of our common

stock. Cash payments from the escrow accounts related to the 2008 conversions were $11 million and borrowed shares equivalent to the number of shares of our common stock issued

upon these conversions were returned to us pursuant to the share lending agreement described above. The borrower returned 10.0 million shares to us in September 2009, almost all of

which were voluntarily returned shares in excess of converted shares, pursuant to the share lending agreement. In October 2011, approximately 16.6 million shares were voluntarily returned

to us by the borrower, leaving 1.4 million shares outstanding under the share lending arrangement. The fair value of similar common shares not subject to our share lending arrangement,

based upon our closing stock price, was approximately $8 million. At December31, 2012, the remaining principal balance was $123 million, which is currently convertible into 27.4 million

shares of our common stock.

(7) At December31, 2012 and 2011, four capital leased Airbus A320 aircraft were included in property and equipment at a cost of $152 million with accumulated amortization of $28 million

and $23 million, respectively. The future minimum lease payments under these non-cancelable leases are $14 million in each of 2013 through 2017 and $82 million in the years thereafter.

Included in the future minimum lease payments is $39 million representing interest, resulting in a present value of capital leases of $113 million with a current portion of $8 million and a

long-term portion of $105 million.

During 2012, we modifi ed the debt secured by three of our Airbus A320 aircraft, effectively lowering the borrowing rates over the remaining term of the

loans. In exchange for lower borrowing rates associated with two of these aircraft loans, we deposited funds equivalent to the outstanding principal

balance, a total of approximately $57 million, as discussed in Note 1. The deposit, which is included in long-term investment securities on our consolidated

balance sheet, will be reduced as quarterly principal payments are made. If we withdraw the funds deposited, the interest rate on the debt reverts back

to the original borrowing rate.

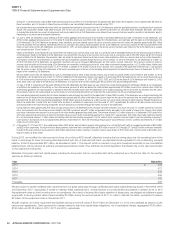

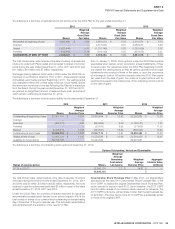

Maturities of long-term debt and capital leases, including the assumption that our convertible debt will be redeemed upon the fi rst put date, for the next fi ve

years are as follows (in millions):

Year Maturities

2013 $ 394

2014 572

2015 258

2016 456

2017 182

Thereafter 989

We are subject to certain collateral ratio requirements in our spare parts pass-through certifi cates and spare engine fi nancing issued in November 2006

and December 2007, respectively. If we fail to maintain these collateral ratios, we are required to provide additional collateral or redeem some or all of

the equipment notes so that the ratios return to compliance. As a result of reduced third party valuation of these parts, we pledged as collateral a spare

engine with a carrying market value of approximately $7 million during the second quarter of 2011. In order to maintain the ratios, we elected to redeem

$3 million of the equipment notes in November 2011.

Aircraft, engines, and other equipment and facilities having a net book value of $3.61 billion at December31, 2012 were pledged as security under

various loan agreements. Cash payments for interest related to debt and capital lease obligations, net of capitalized interest, aggregated $136 million,

$136 million and $138 million in 2012, 2011 and 2010, respectively.