JetBlue Airlines 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2012 10K44

PART II

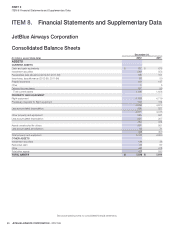

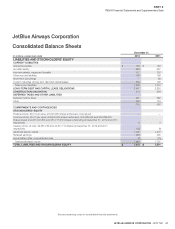

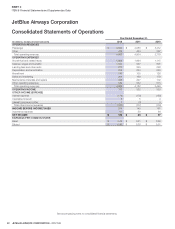

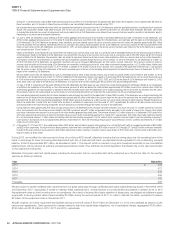

ITEM 8Financial Statements and Supplementary Data

JetBlue Airways Corporation

Consolidated Statements of Cash Flows

(in millions)

YearEndedDecember31,

2012 2011 2010

CASH FLOWS FROM OPERATING ACTIVITIES

Net income $128 $86 $97

Adjustments to reconcile net income to net cash provided by operating activities:

Deferred income taxes 76 58 62

Depreciation 230 213 194

Amortization 39 34 36

Stock-based compensation 13 13 17

(Gains) losses on sale of assets, debt extinguishment, and customer contract

termination (17) 6 —

Collateral (paid) returned for derivative instruments 8 10 (13)

Restricted cash refunded by business partners — — 5

Changes in certain operating assets and liabilities:

Decrease (increase) in receivables 1 (10) (4)

Decrease (increase) in inventories, prepaid and other 38 4 (4)

Increase in air traffi c liability 66 113 70

Increase in accounts payable and other accrued liabilities 92 26 27

Other, net 24 61 36

Net cash provided by operating activities 698 614 523

CASH FLOWS FROM INVESTING ACTIVITIES

Capital expenditures (542) (480) (249)

Predelivery deposits for fl ight equipment (284) (45) (50)

Refund of predelivery deposits for fl ight equipment 1 1 —

Proceeds from the sale of assets 46 — —

Assets constructed for others (2) (3) (14)

Purchase of held-to-maturity investments (444) (450) (866)

Proceeds from maturities of held-to-maturity investments 434 573 414

Purchase of available-for-sale securities (532) (602) (1,069)

Sale of available-for-sale securities 438 503 1,052

Sale of auction rate securities, or ARS — — 85

Net return of security deposits 18 1 1

Net cash used in investing activities (867) (502) (696)

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from:

Issuance of common stock 9 10 9

Issuance of long-term debt 215 245 116

Short-term borrowings 375 128 —

Borrowings collateralized by ARS — — 20

Construction obligation — 6 15

Repayment of:

Long-term debt and capital lease obligations (418) (238) (333)

Short-term borrowings (463) (40) —

Borrowings collateralized by ARS — — (76)

Construction obligation (12) (10) (5)

Other, net (28) (5) (4)

Net cash provided by (used in) fi nancing activities (322) 96 (258)

INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (491) 208 (431)

Cash and cash equivalents at beginning of period 673 465 896

Cash and cash equivalents at end of period $ 182 $ 673 $ 465

See accompanying notes to consolidated fi nancial statements.