JetBlue Airlines 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2012 10K 33

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

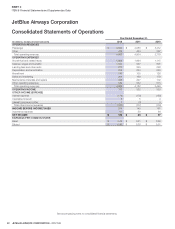

Although we experienced signifi cant revenue growth in 2012, this trend

may not continue. We expect our expenses to continue to increase

signifi cantly as we acquire additional aircraft, as our fl eet ages and as we

expand the frequency of fl ights in existing markets and enter into new

markets. Accordingly, the comparison of the fi nancial data for the quarterly

periods presented may not be meaningful. In addition, we expect our

operating results to fl uctuate signifi cantly from quarter-to-quarter in the

future as a result of various factors, many of which are outside our control.

Consequently, we believe quarter-to-quarter comparisons of our operating

results may not necessarily be meaningful and you should not rely on our

results for any one quarter as an indication of our future performance.

Network Concentrations and Seasonality

We have historically been a highly leisure-focused airline subject to

seasonality in our business. Our focus in recent years has been to increase

our mix of business customers, particularly in Boston, to lessen the

seasonality impact on our business. Additionally, we believe VFR markets

complement our leisure-driven markets from both a seasonal and day of

week perspective. The highest levels of traffi c and revenue on our routes

along the East Coast are generally realized from October through April

and on our routes to and from the western United States in the summer.

Many of our areas of operations in the Northeast experience poor weather

conditions in the winter, causing increased costs associated with de-icing

aircraft, cancelled fl ights and accommodating displaced customers. Many

of our Florida and Caribbean routes experience bad weather conditions

in the summer and fall due to thunderstorms and hurricanes. As we

enter new markets we could be subject to additional seasonal variations

along with competitive responses to our entry by other airlines. Given our

high proportion of fi xed costs, this seasonality may cause our results of

operations to vary from quarter to quarter. As such, we remain focused

on trying to reduce the seasonal impact of our operations and increase

demand and travel during the trough periods.

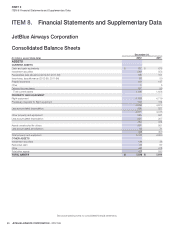

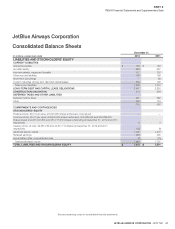

Liquidity and Capital Resources

The airline business is capital intensive. Our ability to successfully execute

our profi table growth plans is largely dependent on the continued availability

of capital on attractive terms. In addition, our ability to successfully operate

our business depends on maintaining suffi cient liquidity. We believe we

have adequate resources from a combination of cash and cash equivalents

and investment securities on hand and two available lines of credit.

Additionally, as of December31, 2012, we had 11 unencumbered A320

aircraft and nine unencumbered spare engines which we believe could

be an additional source of liquidity, if necessary.

We believe a healthy cash balance is crucial to our ability to weather any part

of the economic cycle while continuing to execute on our plans for profi table

growth and increased returns. Our goal is to continue to be diligent with our

liquidity, maintaining fi nancial fl exibility and allowing for prudent capital spending,

which in turn we expect to lead to improved returns for our shareholders.

As of December 31, 2012 our cash balance declined as compared to a year

ago. The current environment of strong industry fundamentals and low interest

rates enabled us to adopt a more reasonable cash balance as compared to

prior years (as measured by a percentage of trailing twelve months revenue).

We believe our current level of cash of approximately 15% of trailing twelve

months revenue, combined with our available lines of credit and portfolio of

unencumbered assets provides us with a strong liquidity position and the

potential for higher returns on cash deployment. We believe we have taken

several important actions during 2012 in solidifying our strong balance sheet

and overall liquidity position, including:

•

Increased our available lines of credit up to $325 million as of December

31, 2012.

•

Prepaid approximately $220 million in high cost debt, which will result

in an annual interest expense savings of approximately $10 million.

•

Increased the number of unencumbered aircraft from one as of December

31, 2011 to 11 as of December 31, 2012.

•Reduced our overall debt balance by $285 million while increasing our

total property and equipment by $483 million during 2012.

•Prepaid $200 million for certain 2013 deliveries and deposits on future

aircraft deliveries in exchange for favorable pricing terms.