JetBlue Airlines 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2012 10K 51

PART II

ITEM 8Financial Statements and Supplementary Data

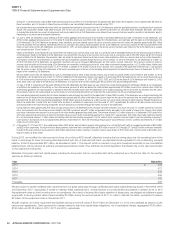

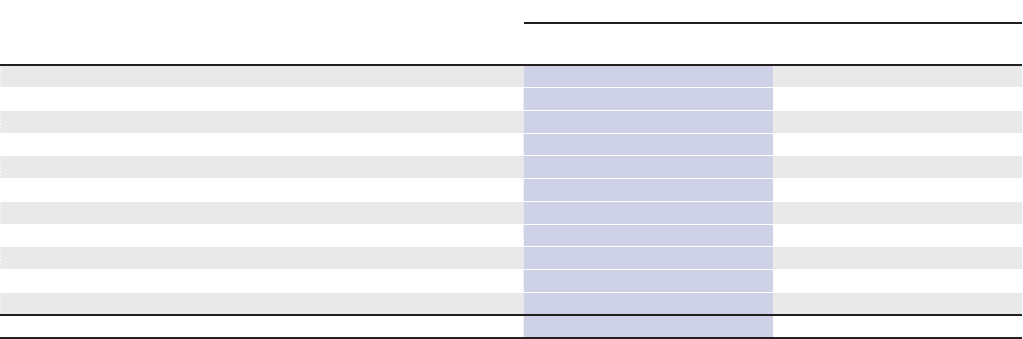

The carrying amounts and estimated fair values of our long-term debt at December31, 2012 and 2011 were as follows (in millions):

December 31, 2012 December 31, 2011

Carrying

Value Estimated

FairValue Carrying

Value Estimated

FairValue

Public Debt

Floating rate enhanced equipment notes

Class G-1, due 2013, 2014, and 2016 $ 173 $ 164 $ 202 $ 185

Class G-2, due 2014 and 2016 373 351 373 316

Class B-1, due 2014 49 48 49 47

Fixed rate special facility bonds, due through 2036 82 82 83 76

6.75% convertible debentures due in 2039 162 225 162 214

5.5% convertible debentures due in 2038 123 173 123 162

Non-Public Debt

Floating rate equipment notes, due through 2025 816 776 743 712

Fixed rate equipment notes, due through 2026 960 1,050 1,192 1,293

TOTAL $ 2,738 $ 2,869 $ 2,927 $ 3,005

The estimated fair values of our publicly held long-term debt are classifi ed

as Level 2 in the fair value hierarchy. The fair values of our enhanced

equipment notes and our special facility bonds were based on quoted

market prices in markets with low trading volumes. The fair value of our

convertible debentures was based upon other observable market inputs

since they are not actively traded. The fair value of our non-public debt

was estimated using a discounted cash fl ow analysis based on our

borrowing rates for instruments with similar terms and therefore classifi ed

as Level 3 in the fair value hierarchy. The fair values of our other fi nancial

instruments approximate their carrying values. Refer to Note 14 for

additional information on fair value.

We utilize a policy provider to provide credit support on the Class G-1 and

Class G-2 certifi cates. The policy provider has unconditionally guaranteed

the payment of interest on the certifi cates when due and the payment of

principal on the certifi cates no later than 18 months after the fi nal expected

regular distribution date. The policy provider is MBIA Insurance Corporation

(a subsidiary of MBIA, Inc.).

We have determined that each of the trusts related to our aircraft EETCs

meet the defi nition of a variable interest entity as defi ned in the Consolidations

topic of the Codifi cation and must be considered for consolidation in

our fi nancial statements. Our assessment of the EETCs considers both

quantitative and qualitative factors, including whether we have the power

to direct the activities and to what extent we participate in the sharing of

benefi ts and losses. We evaluated the purpose for which these trusts were

established and nature of risks in each. These trusts were not designed

to pass along variability to us. We concluded that we are not the primary

benefi ciary in these trusts due to our involvement in them being limited

to principal and interest payments on the related notes and the variability

created by credit risk related to us and the likelihood of our defaulting

on the notes. Therefore, we have not consolidated these trusts in our

fi nancial statements.

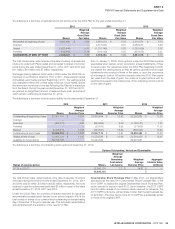

Short-term Borrowings

Unsecured Revolving Credit Facility

In September 2011, we entered into a corporate purchasing line with

American Express, which allows us to borrow up to a maximum of

$125 million. Borrowings cannot exceed $30 million per week and may

only be used for the purchase of jet fuel. Borrowings on this corporate

purchasing line are subject to our compliance with the terms and conditions

of the credit agreement, including certain fi nancial covenants which include

a requirement to maintain certain cash and short term investment levels

and a minimum earnings before income taxes, interest, depreciation and

amortization, or EBITDA margin, as well as customary events of default.

Borrowings, which are to be paid monthly, are subject to a 6.9% annual

interest rate but could be higher if borrowing activity does not reach certain

levels. This borrowing facility will terminate no later than January5, 2015.

As of December31, 2012, we did not have a balance outstanding under

this line of credit.

Morgan Stanley Line of Credit

In July 2012, we entered into a revolving line of credit with Morgan Stanley

for up to approximately $100 million, and in December 2012, the available

line was increased to allow for borrowings up to $200 million. This line of

credit is secured by a portion of our investment securities held by them and

the amount available to us under this line of credit may vary accordingly.

This line of credit bears interest at a fl oating rate based upon LIBOR plus

100 basis points. As of December31, 2012, we did not have a balance

outstanding under this line of credit.