JetBlue Airlines 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2012 10K28

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

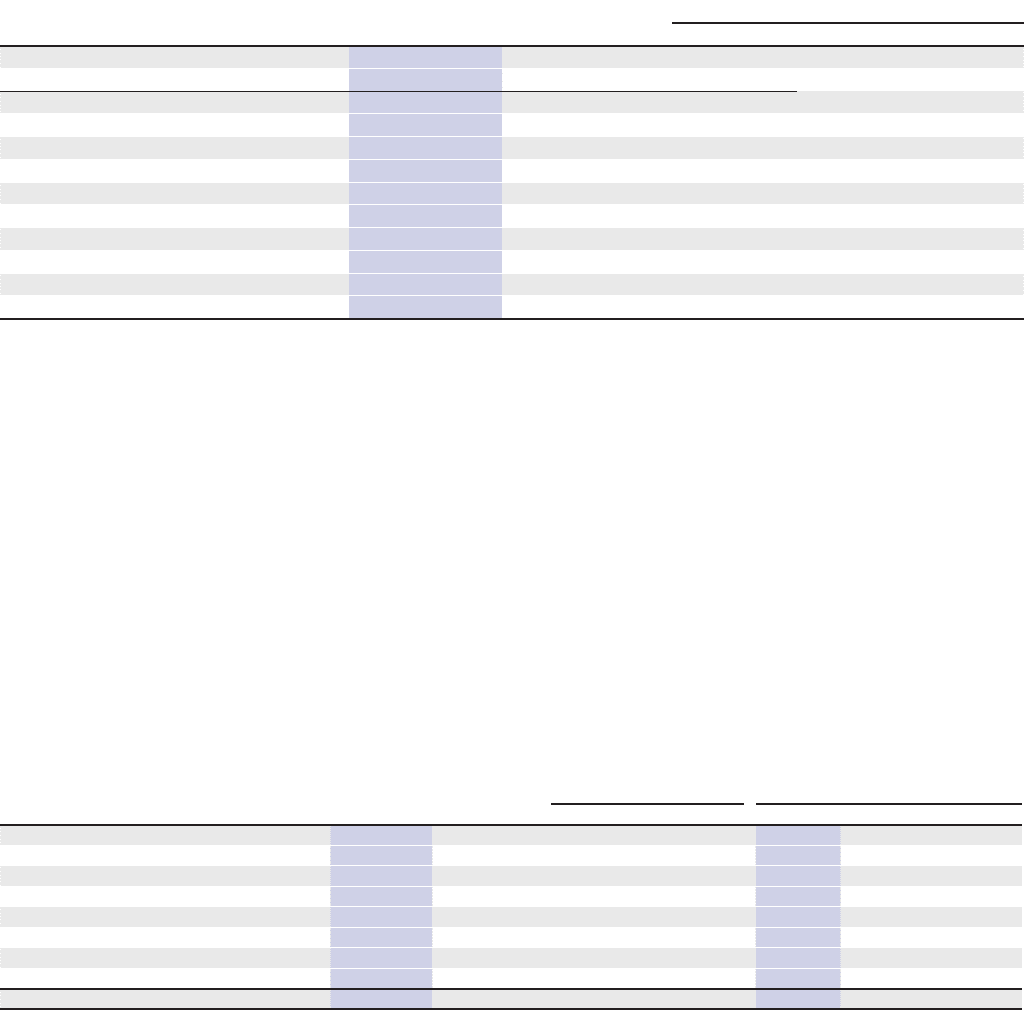

Operating Revenues

(Revenues in millions)

2012 2011

Year-over-Year Change

$%

Passenger Revenue $ 4,550 $ 4,080 $ 470 11.5

Other Revenue 432 424 8 2.0

Operating Revenues $ 4,982 $ 4,504 $ 478 10.6

Average Fare $ 157.11 $ 154.74 2.37 1.5

Yield per passenger mile (cents) 13.55 13.29 0.26 2.0

Passenger revenue per ASM (cents) 11.35 10.96 0.39 3.6

Operating revenue per ASM (cents) 12.43 12.10 0.33 2.8

Average stage length (miles) 1,085 1,091 (6) (0.5)

Revenue passengers (thousands) 28,956 26,370 2,586 9.8

Revenue passenger miles (millions) 33,563 30,698 2,865 9.3

Available Seat Miles (ASMs) 40,075 37,232 2,843 7.6

Load Factor 83.8% 82.4% 1.4 pts

We derive our revenue primarily from transporting passengers on our

aircraft. Passenger revenue accounted for 91% of our total operating

revenues for the year ended December31, 2012. Revenues generated

from international routes, including Puerto Rico, accounted for 26% of

our total passenger revenues in 2012. Revenue is recognized either when

transportation is provided or after the ticket or customer credit expires.

We measure capacity in terms of available seat miles, which represents

the number of seats available for passengers multiplied by the number

of miles the seats are fl own. Yield, or the average amount one passenger

pays to fl y one mile, is calculated by dividing passenger revenue by revenue

passenger miles. We attempt to increase passenger revenue primarily by

increasing our yield per fl ight which produces higher revenue per available

seat mile, or RASM. Our objective is to optimize our fare mix to increase

our overall average fare while continuing to provide our customers with

competitive fares. Passenger revenue also includes revenue from our

EvenMore™ Space ancillary product offering.

In 2012, the increase in passenger revenues was mainly attributable to

the increased capacity and increase in yield. Our EvenMore

™

Space seats

continued to be a signifi cant ancillary product, generating approximately

$150 million in revenue, an increase of approximately 19% over 2011

primarily as a result of additional EvenMore™ Space seats on our EMBRAER

190 fl eet, increased capacity and revised pricing.

Other revenue consists primarily of fees charged to customers in accordance

with our published policies. These include reservation changes and baggage

limitations, EvenMore™ Speed expedited security, the marketing component

of TrueBlue point sales, concession revenues, revenues associated with

transporting mail and cargo, revenues associated with the ground handling

of other airlines and rental income. Revenues earned by our subsidiary,

LiveTV, LLC, for the sale of, and on-going services provided for, in-fl ight

entertainment systems on other airlines are also included in Other Revenue.

Other revenue increased primarily as a result of an $18 million increase in

revenues from certain passenger related fees such as change fees and

excess baggage. These increased fees were slightly offset by a $10 million

guarantee recorded in 2011 related to our co-branded credit card.

Operating Expenses

(dollars in millions)

2012 2011

Year-over-Year Change per ASM

$ % 2012 2011 % Change

Aircraft fuel and related taxes $ 1,806 $ 1,664 $ 142 8.6 4.50 4.47 0.9

Salaries, wages and benefi ts 1,044 947 97 10.3 2.60 2.54 2.4

Landing fees and other rents 277 245 32 12.8 0.69 0.66 4.8

Depreciation and amortization 258 233 25 10.5 0.65 0.63 2.7

Aircraft rent 130 135 (5) (3.6) 0.33 0.36 (10.4)

Sales and marketing 204 199 5 3.0 0.51 0.53 (4.3)

Maintenance materials and repairs 338 227 111 48.4 0.84 0.61 37.9

Other operating expenses 549 532 17 3.2 1.37 1.43 (4.1)

TOTAL OPERATING EXPENSES $ 4,606 $ 4,182 $ 424 10.1 11.49 11.23 2.3

Aircraft Fuel and Hedging

The price and availability of aircraft fuel are extremely volatile due to global

economic and geopolitical factors we can neither control nor accurately

predict. During 2012 fuel prices remained volatile, increasing 1% over

average 2011 prices. We maintain a diversifi ed fuel hedge portfolio by

entering into a variety of fuel hedge contracts in order to provide some

protection against sharp and sudden volatility and further increases in fuel

prices. In total, we hedged 30% of our total 2012 fuel consumption. We

also use fi xed forward price agreements, or FFPs, which allow us to lock

in a price for fi xed quantities of fuel to be delivered at a specifi ed date

in the future, to manage fuel price volatility. As of December31, 2012,

we had outstanding fuel hedge contracts covering approximately 8% of

our forecasted consumption for the fi rst quarter of 2013 and 5% for the

full year 2013. As of December 31, 2012, we had 6% of our 2013 fuel

consumption requirements covered under FFPs. In January and February

2013, we entered into jet fuel swap and cap agreements covering an

additional 6% of our 2013 forecasted consumption. We will continue to

monitor fuel prices closely and intend to take advantage of reasonable

fuel hedging opportunities as they become available.