JetBlue Airlines 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.JETBLUE AIRWAYS CORPORATION-2012 10K48

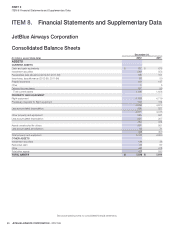

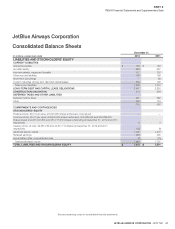

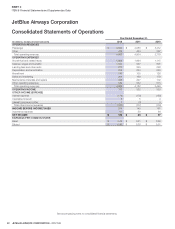

PART II

ITEM 8Financial Statements and Supplementary Data

Loyalty Program: We account for our customer loyalty program, TrueBlue,

by recording a liability for the estimated incremental cost of providing

transportation for outstanding points earned from JetBlue purchases that

we expect to be redeemed. We adjust this liability, which is included in

air traffi c liability, based on points earned and redeemed, changes in the

estimated incremental costs associated with providing travel and changes

in the TrueBlue program.

Points in TrueBlue are also sold to participating companies, including

credit card and car rental companies. These sales are accounted for

as multiple-element arrangements, with one element representing the

travel that will ultimately be provided when the points are redeemed and

the other consisting of marketing related activities that we conduct with

the participating company. The fair value of the transportation portion of

these point sales is deferred and recognized as passenger revenue when

transportation is provided. The marketing portion, which is the excess of

the total sales proceeds over the estimated fair value of the transportation

to be provided, is recognized in other revenue when the points are sold.

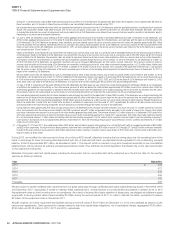

TrueBlue points sold to participating companies which are not

redeemed are recognized as revenue when they expire. We recorded

$5 million, $3 million, and $13 million in revenue related to point expirations

during 2012, 2011 and 2010, respectively.

Our original co-branded credit card agreement, under which we sell

TrueBlue points as described above, provided for a minimum cash

payment guarantee, which was paid to us throughout the life of the

agreement if specifi ed point sales and other ancillary activity payments

were not achieved, and was subject to refund in the event that cash

payments exceeded future minimums through April 2011. We recognized

approximately $10 million and $5 million of other revenue during 2011

and 2010, respectively, related to this guarantee.

Upon the re-launch of the TrueBlue program in November 2009, we

extended our co-branded credit card and membership rewards participation

agreements. In connection with these extensions, we received a one-time

payment of $37 million, which we deferred and are recognizing as other

revenue over the term of the agreement through 2015. We recognized

approximately $7 million, $6 million, and $3 million of revenue related

to this one-time payment during 2012, 2011 and 2010, respectively. In

connection with exclusive benefi ts to be introduced for our co-branded

credit card, we received a one-time payment of $6 million during 2012,

which we have deferred and will recognize as other revenue over the term

of the agreement through 2015. As of December31, 2012, we have not

recorded any revenue related to this one-time payment.

LiveTV Revenues and Expenses: We account for LiveTV’s revenues

and expenses related to the sale of hardware, maintenance of hardware,

and programming services provided as a single unit in accordance with

the Revenue Recognition-Multiple-Element Arrangements topic of the

Codifi cation because we lack objective and reliable evidence of fair

value of the undelivered items. Revenues and expenses related to these

components are recognized ratably over the service periods, which

extend through 2021 as of December31, 2012. Customer advances to

be applied in the next 12 months are included in other current liabilities

on our consolidated balance sheets and those beyond 12 months are

included in other liabilities on our consolidated balance sheets.

Airframe and Engine Maintenance and Repair: Regular airframe

maintenance for owned and leased fl ight equipment is charged to expense

as incurred unless covered by a third-party services contract. We have

separate service agreements covering certain of our scheduled and

unscheduled repair of airframe line replacement unit components and

the engines on our Airbus A320 aircraft. These agreements, which range

from ten to 15 years, require monthly payments at rates based either on

the number of cycles each aircraft was operated during each month or

the number of fl ight hours each engine was operated during each month,

subject to annual escalations. These power by the hour contracts transfer

certain risks, including cost risks, to the third-party service providers and

fi x the amounts we pay per fl ight hour or number of cycles in exchange

for maintenance and repairs under a predefi ned maintenance program,

which are representative of the time and materials that would be consumed.

These payments are expensed as the related fl ight hours or cycles are

incurred. One of our maintenance providers is a subsidiary of a large

shareholder of ours. During 2012, we recorded approximately $7 million

in maintenance expense provided by this related party.

Advertising Costs: Advertising costs, which are included in sales and

marketing, are expensed as incurred. Advertising expense was $57 million

in each of 2012 and 2011, and $55 million in 2010.

Share-Based Compensation: We record compensation expense for

share-based awards based on the grant date fair value of those awards.

Share-based compensation expense includes an estimate for pre-vesting

forfeitures and is recognized over the requisite service periods of the

awards on a straight-line basis, which is generally commensurate with

the vesting term.

Under the Compensation-Stock Compensation topic of the Codifi cation,

the benefi ts associated with tax deductions in excess of recognized

compensation cost are required to be reported as a fi nancing cash fl ow.

We recorded an insignifi cant amount in excess tax benefi ts generated

from option exercises in each of 2012, 2011 and 2010.

Our policy is to issue new shares for purchases under all of our stock

based plans, including our Crewmember Stock Purchase Plan, or CSPP,

and 2011 Crewmember Stock Purchase Plan and issuances under our

Amended and Restated 2002 Stock Incentive Plan, or 2002 Plan, and

our 2011 Incentive Compensation Plan, or 2011 Plan.

Income Taxes: We account for income taxes utilizing the liability method.

Deferred income taxes are recognized for the tax consequences of

temporary differences between the tax and fi nancial statement reporting

bases of assets and liabilities. A valuation allowance for deferred tax assets

is provided unless realizability is judged by us to be more likely than not. Our

policy is to recognize interest and penalties accrued on any unrecognized

tax benefi ts as a component of income tax expense.

New Accounting Standards: Our fi nancial statements are prepared in

accordance with the Codifi cation which was established in 2009 and

superseded all then existing accounting standard documents and has

become the single source of authoritative non-governmental U.S. GAAP.

New accounting rules and disclosure requirements can impact our fi nancial

results and the comparability of our fi nancial statements. Authoritative

literature that has recently been issued which we believe will impact our

consolidated fi nancial statements is described below. There are also several

new proposals under development, including proposals related to leases,

revenue recognition and fi nancial instruments, if and when enacted, may

have a signifi cant impact on our fi nancial statements.

On January 1, 2012, Accounting Standards Update 2011-05, or ASU 2011-

05, amending the Comprehensive Income topic of the Codifi cation, became

effective. This update changes the requirements for the presentation of

other comprehensive income, eliminating the option to present components

of other comprehensive income as part of the statement of changes in

stockholders’ equity, among other things. ASU 2011-05 requires that

all non-owner changes in stockholders’ equity be presented either in a

single continuous statement of comprehensive income or in two separate

but consecutive statements. We have included a separate statement

of comprehensive income in the accompanying consolidated fi nancial

statements for the years ended December31, 2012, 2011 and 2010. In

December 2011, the FASB issued ASU 2011-12, delaying the effective date

of the portion of ASU 2011-05 related to the presentation of reclassifi cation

adjustments out of accumulated other comprehensive income.

On January 1, 2012, ASU 2011-04, which amended the Fair Value

Measurements and Disclosures topic of the Codifi cation, became effective.

The amendments in this update were intended to result in common fair

value measurement and disclosure requirements in U.S. GAAP and

International Financial Reporting Standards, or IFRS. ASU 2011-04

expands and enhances current disclosures about fair value measurements

and clarifi es the FASB’s intent about the application of existing fair value

measurement requirements in certain circumstances. We adopted these

amendments prospectively on January 1, 2012.