JetBlue Airlines 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2012 10K62

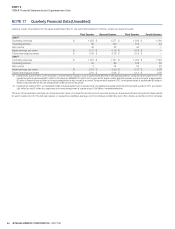

PART II

ITEM 8Financial Statements and Supplementary Data

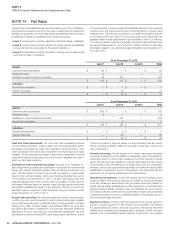

NOTE 14 Fair Value

Under the Fair Value Measurements and Disclosures topic of the Codifi cation,

disclosures are required about how fair value is determined for assets and

liabilities and a hierarchy for which these assets and liabilities must be grouped

is established, based on signifi cant levels of inputs as follows:

•

Level 1 quoted prices in active markets for identical assets or liabilities;

•Level 2 quoted prices in active markets for similar assets and liabilities

and inputs that are observable for the asset or liability; or

•

Level 3 unobservable inputs for the asset or liability, such as discounted

cash fl ow models or valuations.

The determination of where assets and liabilities fall within this hierarchy

is based upon the lowest level of input that is signifi cant to the fair value

measurement. The following is a listing of our assets and liabilities required

to be measured at fair value on a recurring basis and where they are

classifi ed within the fair value hierarchy (as described in Note 1) (in millions).

The carrying values of all other fi nancial instruments approximated their

fair values at December31, 2012 and 2011. Refer to Note 2 for fair value

information related to our outstanding debt obligations as of December31,

2012 and 2011.

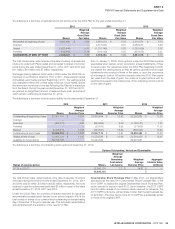

As of December 31, 2012

Level1 Level2 Level3 Total

Assets

Cash and cash equivalents $ 84 $ — $ — $ 84

Restricted cash 4 — — 4

Available-for-sale investment securities 68 207 — 275

$ 156 $ 207 $ — $ 363

Liabilities

Aircraft fuel derivatives $ — $ 1 $ — $ 1

Interest rate swap — 12 — 12

$ —$ 13$ —$ 13

As of December 31, 2011

Level1 Level2 Level3 Total

Assets

Cash and cash equivalents $ 555 $ — $ — $ 555

Restricted cash 4 — — 4

Available-for-sale investment securities — 253 — 253

Aircraft fuel derivatives — 5 — 5

$ 559 $ 258 $ — $ 817

Liabilities

Aircraft fuel derivatives $ — $ 9 $ — $ 9

Interest rate swap — 20 — 20

$ —$ 29$ —$ 29

Cash and Cash Equivalents: Our cash and cash equivalents include

money market securities, treasury bills, and commercial paper which

are readily convertible into cash with maturities of three months or less

when purchased, all of which are considered to be highly liquid and easily

tradable. These securities are valued using inputs observable in active

markets for identical securities and are therefore classifi ed as Level 1

within our fair value hierarchy.

Available-for-sale investment securities: Included in our available-for-

sale investment securities are certifi cates of deposits and commercial

paper with original maturities greater than 90 days but less than one

year. The fair values of these instruments are based on observable

inputs in non-active markets, which are therefore classifi ed as Level 2

in the hierarchy. At December 31, 2012, we also held treasury bills with

maturities greater than three months when purchased. The fair value of

the treasury bills are based on actively traded quoted market prices and

are therefore classifi ed as Level 1 in the hierarchy. We did not record any

signifi cant gains or losses on these securities during the twelve months

ended December31, 2012 or 2011.

Auction rate securities: We had historically held auction rate securities,

or ARS, long-term debt securities for which interest rates reset regularly

at pre-determined intervals, typically 28 days, through an auction process.

During 2010, UBS, a broker-dealer, re-purchased ARS from us at their

par value of $85 million in satisfaction of a previously executed settlement

agreement. Prior to entering into the settlement agreement, we had

estimated the value of these ARS using discounted cash fl ows, a level

3 input, as a result of their par values not approximating their fair values.

The re-purchase of ARS by UBS did not result in a net gain or loss in the

year of settlement.

Interest rate swaps: The fair values of our interest rate swaps are based

on inputs received from the related counterparty, which are based on

observable inputs for active swap indications in quoted markets for similar

terms. We had previously classifi ed our interest rate swaps as Level 3 inputs

in the hierarchy with the belief some of these inputs were not observable.

However, since these inputs are all observable, we believe the appropriate

classifi cation is as Level 2 inputs in the hierarchy. We have refl ected this

adjustment for all periods presented in the tables above.

Aircraft fuel derivatives: Our jet fuel swaps, jet fuel, heating oil and

crude oil collars, and crude oil caps are not traded on public exchanges.

Their fair values are determined using a market approach based on

inputs that are readily available from public markets for commodities and

energy trading activities; therefore, they are classifi ed as Level 2 inputs.

The data inputs are combined into quantitative models and processes

to generate forward curves and volatilities related to the specifi c terms of

the underlying hedge contracts.

Spectrum license: In 2006, LiveTV acquired an air-to-ground spectrum

license in a public auction from the Federal Communications Commission

for approximately $7 million.Since its acquisition, the license has been

treated as an indefi nite lived intangible asset, refl ected in other long term

assets in our consolidated balance sheets. In late 2007, we unveiled