JetBlue Airlines 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2012 10K32

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

Quarterly Results of Operations

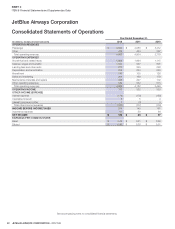

The following table sets forth selected fi nancial data and operating statistics for the four quarters ended December31, 2012. The information for each

of these quarters is unaudited and has been prepared on the same basis as the audited consolidated fi nancial statements appearing elsewhere in this

Form10-K.

Three Months Ended

March31,

2012 June30,

2012 September30,

2012 December31,

2012

Statements of Operations Data (dollars in millions)

Operating revenues $ 1,203 $ 1,277 $ 1,308 $ 1,194

Operating expenses:

Aircraft fuel and related taxes 433 450 481 442

Salaries, wages and benefi ts 255 265 262 262

Landing fees and other rents 66 72 73 66

Depreciation and amortization 61 63 66 68

Aircraft rent 33 33 32 32

Sales and marketing 47 54 51 52

Maintenance materials and repairs 88 85 85 80

Other operating expenses

(1) 131 125 145 148

Total operating expenses 1,114 1,147 1,195 1,150

Operating income

(2) 89 130 113 44

Other income (expense)

(3) (40) (44) (40) (43)

Income before income taxes 49 86 73 1

Income tax expense 19 34 28 —

NET INCOME $ 30 $ 52 $ 45 $ 1

Operating margin 7.4% 10.2% 8.6% 3.7%

Pre-tax margin 4.0% 6.7% 5.6% 0.1%

Operating Statistics:

Revenue passengers (thousands) 6,853 7,338 7,747 7,018

Revenue passenger miles (millions) 7,908 8,497 9,075 8,083

Available seat miles ASM (millions) 9,536 9,961 10,704 9,874

Load factor 82.9% 85.3% 84.8% 81.9%

Aircraft utilization (hours per day) 11.6 11.8 12.4 11.3

Average fare $ 159.93 $ 159.58 $ 154.04 $ 155.17

Yield per passenger mile (cents) 13.86 13.78 13.15 13.47

Passenger revenue per ASM (cents) 11.49 11.76 11.15 11.03

Operating revenue per ASM (cents) 12.62 12.82 12.21 12.09

Operating expense per ASM (cents) 11.69 11.51 11.16 11.65

Operating expense per ASM, excluding fuel (cents) 7.15 6.99 6.67 7.17

Operating expense per ASM, excluding fuel and profi t

sharing (cents) 7.15 6.92 6.63 7.26

Airline operating expense per ASM (cents)

(4) 11.59 11.35 10.99 11.47

Departures 63,546 66,067 69,925 65,062

Average stage length (miles) 1,077 1,081 1,094 1,089

Average number of operating aircraft during period 170.3 172.4 175.0 177.8

Average fuel cost per gallon, including fuel taxes $ 3.25 $ 3.22 $ 3.17 $ 3.20

Fuel gallons consumed (millions) 133 140 152 138

Full-time equivalent employees at period end

(4) 11,965 12,308 11,797 12,070

(1) During the first quarter of 2012, LiveTV recorded a gain of approximately $8 million related to the termination of a customer contract. During the second quarter of 2012, we recorded net

gains of approximately $10 million related to the sale of two EMBRAER 190 aircraft and six spare aircraft engines.

(2) During the fourth quarter of 2012, operating income was negatively impacted by approximately $30 million as a result of Hurricane Sandy.

(3) During the second and fourth quarters of 2012, we recorded $2 million in gains and $3 million in losses, respectively, related to the early extinguishment of a portion of our long-term debt.

(4) Excludes results of operations and employees of LiveTV, LLC, which are unrelated to our airline operations and are immaterial to our consolidated operating results.