JetBlue Airlines 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

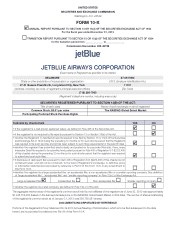

JETBLUE AIRWAYS CORPORATION-2012 10K 09

PART I

ITEM 1Business

In considering new markets, we generally focus on either underserved

markets or those with high average fares. As a part of this process, we

analyze publicly available data from the Department of Transportation,

or DOT, showing the historical number of passengers, capacity and

average fares over time. Using this data, combined with our knowledge

and experience about how comparable markets have reacted in the past

to capacity changes, we forecast the expected level of demand that may

result from our introduction of service and lower prices. We also consider

the anticipated response of existing airlines in the particular market. When

deciding upon and entering new markets, we analyze the uniqueness of

each market and design our operations to target the customer base which

will allow us to compete effectively and grow profi tably. For example, in

the Caribbean our operations are primarily targeted on the leisure traveler,

whereas in Boston, we are focused on both the business traveler and

the leisure traveler.

These forecast techniques are designed to portray what we expect the

market to produce upon maturity. We measure maturity of a market based

upon cash break-even and profi tability. We consider, among other things,

the level of investment we believe may be required to reach a steady

state of performance in a given market. Each route analysis is unique for

many reasons including, but not limited to, geography, demographics,

competitive dynamics and our existing size in the market. Generally, a

business market takes two to three years to fully mature. High leisure

Caribbean markets, however, have in some cases, matured in as little

as six months. Our key objective is to achieve a sustainable growth rate

by offsetting the investment in new markets with the cash and profi ts

generated from mature markets.

Commercial Partnerships. Airlines frequently participate in marketing

alliances which, among other things, generally provide for code-sharing,

frequent fl yer program reciprocity, coordinated fl ight schedules and other

joint marketing activities. Our commercial agreements typically begin as

an interline agreement, which allows a customer to book one ticket with

itineraries on multiple airlines. As we expand our portfolio of commercial

partnerships, we have also deepened the relationship with some of our

existing partners from a basic interline agreement to include a code-share

element in which one airline places its name and fl ight number on fl ights

operated by another airline. The benefi ts of broad networks potentially

attract more customers and expand our growing network. We currently

participate in several commercial partnerships, primarily interline agreements,

and will continue to seek additional strategic opportunities as they arise.

We believe our commercial partnerships allow us to leverage our strong

network and drive incremental traffi c and revenue while improving our

off-peak periods.

Our commercial partnerships, of which there are currently 22, are structured

with gateways primarily at New York’s JFK and Boston’s Logan International

Airport. These arrangements allow international travelers, whom we do not

otherwise serve, to easily access many of our key domestic and Caribbean

routes. Our partners include many notable international carriers. We plan

on continuing to add commercial partners throughout 2013.

Customer Loyalty Program. TrueBlue is an online program designed

to reward and recognize our most loyal customers. The program offers

incentives to increase members’ travel on JetBlue. TrueBlue members earn

points based upon the amount paid for JetBlue fl ights. Member accounts

accumulate points which do not expire as long as new fl ight points are

earned at least once in a 12-month period. Redemption of points for a

one-way fl ight can begin once a member attains as few as 5,000 points.

The program has no black-out dates or seat restrictions and any JetBlue

destination can be booked if the member has enough points to exchange

for the value of an open seat.

There were approximately 753,000 travel segments fl own during 2012.

TrueBlue award miles fl own represent approximately 3% of our total

revenue passenger miles.

In 2012, we introduced a new badge of TrueBlue for our most loyal

customers called Mosaic. In order to qualify for Mosaic status, TrueBlue

members must either (1)fl y a minimum of 30times with JetBlue and acquire

at least 12,000 base fl ight points within a calendar year; or (2)accumulate

15,000 base fl ight points within a calendar year. Mosaic customers enjoy

benefi ts including free EvenMore

TM

Speed, early boarding, access to a

dedicated Customer service line available 24 hours a day/7days a week,

a free second bag checked and free EvenMoreTM Space seat upgrades.

We have an agreement with American Express under which it issues JetBlue

co-branded American Express credit cards, allowing cardmembers to earn

TrueBlue points. We have a separate agreement with American Express

allowing any American Express cardholder to convert their Membership

Rewards points into TrueBlue points. Additionally, we have agreements

with other loyalty partners, including hotels and car rental companies,

allowing their customers to earn TrueBlue points through participation in

the partners’ programs. We intend to develop and pursue other loyalty

partnerships in the future.

In 2012, we launched an international co-branded loyalty credit card jointly

with Banco Santander Puerto Rico and Mastercard. This new Santander

JetBlue Mastercard allows our customers in Puerto Rico - where we

are the largest carrier - the ability to take full advantage of our TrueBlue

loyalty program.

Our Cost Structure and Operations

Our cost structure has allowed us to price fares lower than many of our

larger competitors while offering an award-winning product and service.

Our network initiatives and growth plans require a low cost platform.

Maintaining a low cost structure relative to our competitors is fundamental

to our sustainable growth and profi tability. For the year ended December31,

2012, our cost per available seat mile, excluding fuel, of 6.99 cents is

among the lowest reported by all other major U.S. airlines. However, as our

fl eet and workforce age, it is increasingly diffi cult to maintain this marginal

advantage relative to our competitors. There are several contributing

factors to our cost advantage, including high aircraft utilization, new and

effi cient aircraft, limited fl eet types, relatively low distribution costs, and

a productive workforce.

We are continually focused on maintaining a cost advantage relative to

our competitors while offering a high-quality product and service our

customers value. We believe in making investments that will deliver future

benefi ts, preserve our low cost advantage and drive effi ciency. Examples

of such investments include sharklets for our A320 aircraft to increase fuel

effi ciency and our construction of an international arrival facility at Terminal

5 in New York to streamline our international operations.

Infrastructure

Unlike many network carriers operating under a hub-and-spoke system,

our point-to-point system is the foundation of our operation. The majority of

our routes are served by at least one of our six focus cities. This structure

allows us to optimize costs and generate a revenue premium in certain

markets as we are able to accommodate customers’ preference for

non-stop itineraries. During 2012 and 2011, approximately 90% of our

customers fl ew on non-stop itineraries.

A vast majority of our operations are centered in and around the northeast

corridor of the United States encompassing some of the most populated

airspace in the world. Operating in this congested airspace, however,

makes us susceptible to certain operational constraints, including the

increased susceptibility of prolonged recovery times stemming from

weather events. We are continually working on ways to increase our

overall operational effi ciencies, including investing in technology and more

robust operational systems. During 2012, we made several important

technological advancements. In particular, we were among the industry

leaders in the efforts towards implementing the Next Generation Air