JetBlue Airlines 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2012 10K36

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

Contractual Obligations

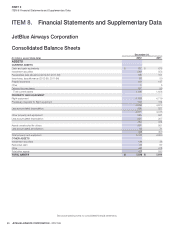

Our noncancelable contractual obligations at December31, 2012 include (in millions):

Payments due in

Total 2013 2014 2015 2016 2017 Thereafter

Long-term debt and capital lease

obligations

(1) $ 3,450 $ 509 $ 673 $ 342 $ 527 $ 236 $ 1,163

Lease commitments 1,492 198 194 191 125 111 673

Flight equipment obligations 5,005 360 525 745 765 575 2,035

Financing obligations and other

(2) 2,915 399 331 306 293 306 1,280

TOTAL $ 12,862 $ 1,466 $ 1,723 $ 1,584 $ 1,710 $ 1,228 $ 5,151

(1) Includes actual interest and estimated interest for floating-rate debt based on December31, 2012 rates.

(2) Amounts include noncancelable commitments for the purchase of goods and services.

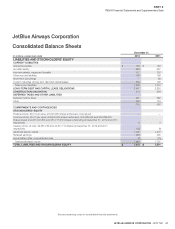

The interest rates are fi xed for $1.72 billion of our debt and capital lease

obligations, with the remaining $1.13 billion having fl oating interest rates.

The fl oating interest rates adjust quarterly or semi-annually based on the

London Interbank Offered Rate, or LIBOR. The weighted average maturity

of all of our debt was 6 years at December31, 2012. We are subject to

certain fi nancial ratios for our unsecured line of credit issued in September

2011, including a requirement to maintain certain cash and short-term

investment levels and a minimum earnings before income taxes, interest,

depreciation and amortization, or EBITDA margin, as well as customary

events of default. We are subject to certain collateral ratio requirements

in our spare parts pass-through certifi cates and spare engine fi nancing

issued in November 2006 and December 2007, respectively. If we fail

to maintain these collateral ratios, we are required to provide additional

collateral or redeem some or all of the equipment notes so the ratios return

to compliance. As a result of lower spare parts inventory balances and the

associated reduced third party valuation of these parts, we pledged as

collateral a previously unencumbered spare engine with a carrying value

of approximately $7 million during the second quarter of 2011. During the

third quarter of 2011, we did not meet the minimum ratios on our spare

parts pass-through certifi cates due to the reduced third party valuation of

these parts. In order to maintain the ratios, we elected to redeem $3 million

of the equipment notes in November 2011. At December31, 2012, we

were in compliance with all covenants of our debt and lease agreements

and 70% of our owned property and equipment were pledged as security

under various loan agreements.

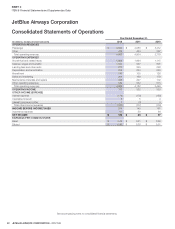

We have operating lease obligations for 60 aircraft with lease terms that

expire between 2014 and 2026. Five of these leases have variable-rate rent

payments that adjust semi-annually based on LIBOR. We also lease airport

terminal space and other airport facilities in each of our markets, as well as

offi ce space and other equipment. We have approximately $30million of

restricted assets pledged under standby letters of credit related to certain

of our leases which will expire at the end of the related leases.

Our fi rm aircraft orders at December31, 2012 consisted of 14 Airbus

A320 aircraft, 30 Airbus A321 aircraft, 40 Airbus A320 neo aircraft and

31 EMBRAER 190 aircraft scheduled for delivery as follows 14 in 2013,

10 in 2014, 17 in 2015, 18 in 2016, 13 in 2017, 13 in 2018, 10 in 2019,

10 in 2020 and 10 in 2021. We expect to meet our predelivery deposit

requirements for our aircraft by paying cash or by using short-term

borrowing facilities for deposits required sixto 24months prior to delivery.

Any predelivery deposits paid by the issuance of notes are fully repaid at

the time of delivery of the related aircraft.

Our aircraft orders refl ect contract modifi cations entered in 2012.In July

2012, we amended our EMBRAER purchase agreement accelerating the

delivery of one aircraft to 2013 which was previously scheduled for delivery

in 2014. Additionally, we extended the date by which we may elect not to

further amend our purchase agreement to order a new EMBRAER 190

variant, if developed, to July 31, 2013. If the new variant is not elected,

seven EMBRAER 190 aircraft we previously deferred may either be returned

to their original delivery dates in 2013 and 2014 or canceled and subject to

cancellation fees. In December 2012, we further amended this agreement

effectively accelerating the delivery of four aircraft from 2018 to 2013.

In October 2008, we began operating out of our new Terminal 5 at JFK,

or Terminal 5, which we had been constructing since November 2005.

The construction and operation of this facility is governed by a lease

agreement we entered into with the PANYNJ in 2005.We are responsible

for making various payments under the lease, including ground rents for

the terminal site which began on lease execution in 2005 and facility rents

commenced in October 2008 upon our occupancy of the terminal.The

facility rents are based on the number of passengers enplaned out of the

terminal, subject to annual minimums.The PANYNJ has reimbursed us

for costs of this project in accordance with the terms of the lease, except

for approximately $76 million in leasehold improvements provided by us.

For fi nancial reporting purposes, this project is being accounted for as a

fi nancing obligation, with the constructed asset and related liability being

refl ected on our balance sheets.Minimum ground and facility rents for

this terminal totaling $1.12 billion are included in the commitments table

above as lease commitments and fi nancing obligations.

Our commitments also include those of LiveTV, which has several

noncancelable long-term purchase agreements with various suppliers

to provide equipment to be installed on its customers’ aircraft, including

JetBlue’s aircraft.

We enter into individual employment agreements with each of our FAA-

licensed Crewmembers as well as inspectors and air traffi c controllers.

Each employment agreement is for a term of fi ve years and automatically

renews for an additional fi ve-year term unless the Crewmember is terminated

for cause or the Crewmember elects not to renew it. Pursuant to these

agreements, these Crewmembers can only be terminated for cause. In

the event of a downturn in our business requiring a reduction in fl ying

and related work hours, we are obligated to pay these Crewmembers

a guaranteed level of income and to continue their benefi ts. As we are

not currently obligated to pay this guaranteed income and benefi ts, no

amounts related to these guarantees are included in the table above.