Hyundai 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

HYUNDAI MOTOR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2007 AND 2006

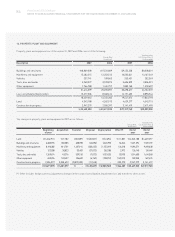

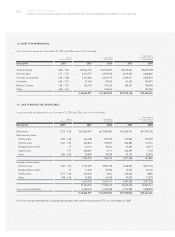

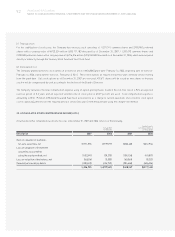

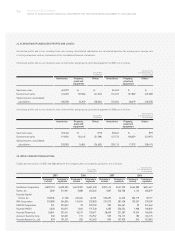

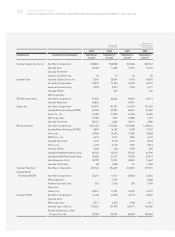

21. STATEMENTS OF COMPREHENSIVE INCOME:

Statements of comprehensive income in 2007 and 2006 consist of the following:

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Description 2007 2006 2007 2006

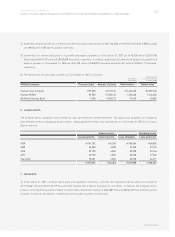

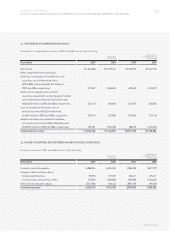

Income tax currently payable 848,494 504,555 $904,385 $537,790

Changes in deferred taxes due to:

Temporary differences 98,953 149,559 105,471 159,411

Carry forward of unused tax credits (27,206) (124,802) (28,998) (133,023)

Items directly charged to equity (267,508) 186,446 (285,129) 198,728

Income tax expense 652,733 715,758 $695,729 $762,906

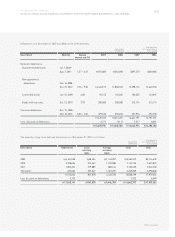

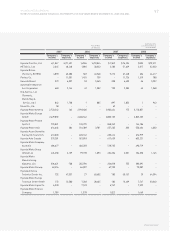

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Description 2007 2006 2007 2006

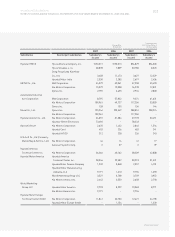

Net income 1,600,480 1,259,247 $1,705,905 $1,342,195

Other comprehensive income (loss):

Gain (loss) on valuation of available-for-sale

securities, net of deferred tax effect

(216,896) million and 60,167 million in

2007 and 2006, respectively. 571,817 (158,623) 609,483 (169,072)

Gain (loss) on valuation of investment

securities accounted for using the equity method,

net of deferred tax effect 14,267 million and

(22,247) million in 2007 and 2006, respectively. (63,121) 206,950 (67,279) 220,582

Loss on valuation of derivatives, net of

deferred tax effect 20,301 million and

4,667 million in 2007 and 2006, respectively. (53,521) (12,305) (57,046) (13,116)

Gain(loss) on overseas operation translation,

net of deferred tax effect (64,138) million and

60,393 million in 2007 and 2006, respectively. 169,091 (159,218) 180,229 (169,705)

Comprehensive income 2,224,746 1,136,051 $2,371,292 $1,210,884

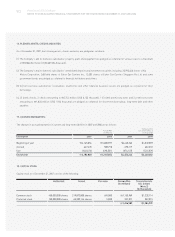

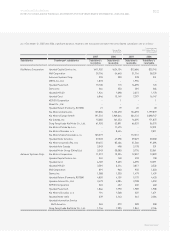

22. INCOME TAX EXPENSE AND DEFERRED INCOME TAX ASSETS (LIABILITIES):

Income tax expense in 2007 and 2006 consists of the following: