Hyundai 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

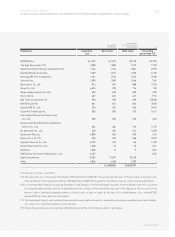

63

HYUNDAI MOTOR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2007 AND 2006

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

Basis of Consolidated Financial Statement Presentation

The Company maintains its official accounting records in Korean Won and prepares statutory consolidated financial statements in the

Korean language (Hangul) in conformity with the accounting principles generally accepted in the Republic of Korea. Certain accounting

principles applied by the Company that conform with financial accounting standards and accounting principles in the Republic of Korea may

not conform with generally accepted accounting principles in other countries. Accordingly, these financial statements are intended for use

by those who are informed about Korean accounting principles and practices. The accompanying financial statements have been

condensed, restructured and translated into English from the Korean language financial statements. Certain information included in the

Korean language financial statements, but not required for a fair presentation of the Company and its subsidiaries’ financial position,

results of operations, changes in shareholders’ equity or cash flows, is not presented in the accompanying financial statements.

The accompanying financial statements are stated in Korean Won, the currency of the country in which the Company is incorporated and

operates. The translation of Korean Won amounts into U.S. dollar amounts is included solely for the convenience of readers outside of the

Republic of Korea and has been made at the rate of 938.20 to US$1.00 at December 31, 2007, the Base Rate announced by Seoul Money

Brokerage Service, Ltd. Such translations should not be construed as representations that the Korean Won amounts could be converted

into U.S. dollars at that or any other rate.

The Company prepared its consolidated financial statements as of December 31, 2007 in accordance with accounting principles generally

accepted in the Republic of Korea. The significant accounting policies followed by the Company in the preparation of its consolidated

financial statements as of December 31, 2007 are identical to those as of December 31, 2006, except for the adoption of additional SKAS

No.11 - “Discontinuing operations”, No.21 - “Preparation and presentation of financial statements”, No.22 - “Share-based payment”, No.23

- “Earning per share”, No.24 - “Preparation and presentation of financial statements” and No.25 - “Consolidated financial statements”,

which were effective from January 1, 2007.

The significant accounting policies followed by the Company in the preparation of its consolidated financial statements are summarized

below.

Principles of Consolidation

The accompanying financial statements include the accounts of the Company and its subsidiaries. Under financial accounting standards for

consolidated financial statements in the Republic of Korea, a company is regarded as a subsidiary of another company if more than 50% of

its issued share capital is held by the other company, or more than 30% of its issued share capital is held by the other company and that

company is the largest shareholder, or substantially controlled by the other company. Investments of 20% to 50% in affiliated companies or

investments in affiliated companies over which the Company exerts a significant influence are accounted for using the equity method.

Under the equity method, the original investment is recorded at cost and adjusted by the Company's share on the undistributed earnings or

losses of these companies.

The fiscal year of the consolidated subsidiaries is the same as that of the Company. Differences in accounting policy between the Company

and consolidated subsidiaries are adjusted in the consolidation.

Investments and equity accounts of subsidiaries were eliminated at the dates the Company obtained control of the subsidiaries. The

difference between the cost of acquisition and the book value of the subsidiary is amortized using the straight-line method within twenty

years (five years for goodwill recognized before 1998) from the year the acquisition occurred or reversed over the remaining weighted

average useful life of the identifiable acquired depreciable assets for negative goodwill using the straight-line method.