Hyundai 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

HYUNDAI MOTOR COMPANY

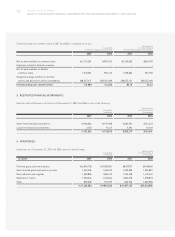

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2007 AND 2006

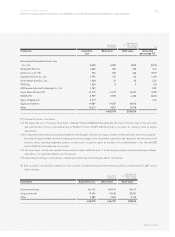

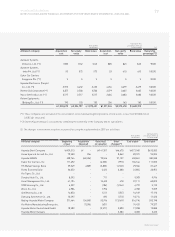

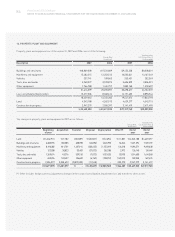

Korean Won

(In millions) (%)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Companies Acquisition Book value Book value Ownership

cost percentage (*2)

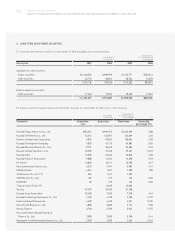

International Convention Center Jeju

Co., Ltd. 500 500 $533 $0.30

Hankyoreh Plus Inc. 4,800 284 303 5.43

Carnes Co., Ltd. (*3) 250 250 266 49.99

Hyundai Unicorns Co., Ltd. 5,795 137 146 14.90

Korea Smart Card Co., Ltd. 1,628 22 23 5.31

ROTIS Inc. 1,000 8 9 1.33

GM Daewoo Auto and Technology Co., Ltd. 2,187 - - 0.02

Seoul Metro 9th line (*4) 41,779 41,779 44,531 49.02

HMCIS (*3) 3,959 3,959 4,220 80.00

Space Imaging LLC 5,319 - - 2.16

Equity investments 19,587 19,587 20,876 -

Other 10,679 9,831 10,478 -

690,999 $736,516

(*1) Disposal of stocks is restricted.

(*2) The acquisition cost of Treasury Stock Fund is 26,647 million (US$28,402 thousand) and the lower of the fair value of treasury stock

and investments in those fund amounting to 18,227 million (US$19,428 thousand) is recorded as treasury stock in capital

adjustments.

(*3) In conformity with Financial Accounting Standards in the Republic of Korea, the equity securities of these affiliates were not accounted

for using the equity method since the Company believes the changes in the investment value due to the changes in the net assets of the

investee, whose individual beginning balance of total assets or paid-in capital at the date of its establishment is less than 7,000

million (US$7,461 thousand), are not material.

(*4) This investment security was excluded from using the equity method despite its ownership percentage exceeding twenty percentages,

since there is no significant influence on the investee.

(*5) Ownership percentage is calculated by combining the ownership of the Company and its subsidiaries.

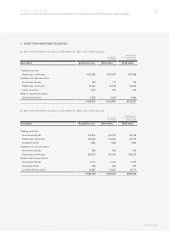

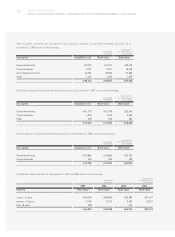

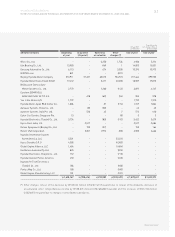

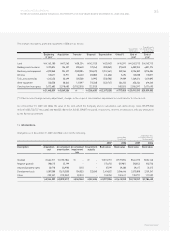

(3) Debt securities, classified into available-for-sale securities, included in long-term investment securities as of December 31, 2007 consist

of the following:

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Description Acquisition cost Book value Book value

Government bonds 4,132 4,144 $4,417

Corporate bonds 19,694 19,678 20,974

Other 3,089 2,948 3,143

26,915 26,770 $28,534