Hyundai 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114 HYUNDAI MOTOR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2007 AND 2006

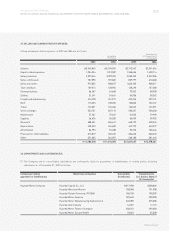

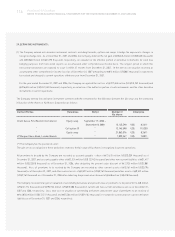

29.DERIVATIVE INSTRUMENTS:

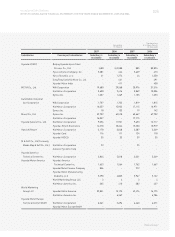

(1) The Company entered into derivative instrument contracts including forwards, options and swaps to hedge the exposure to changes in

foreign exchange rate. As of December 31, 2007 and 2006, the Company deferred the net gain of 28,526 million (US$30,405 thousand)

and 20,068 million (US$21,390 thousand), respectively, on valuation of the effective portion of derivative instruments for cash flow

hedging purposes from forecasted exports as accumulated other comprehensive income (loss). The longest period in which the

forecasted transactions are expected to occur is within 47 months from December 31, 2007. Of the net loss on valuation recorded as

accumulated other comprehensive income (loss) as of December 31, 2007 amounting to 812 million (US$865 thousand) is expected to

be realized and charged to current operations within one year from December 31, 2007.

For the year ended December 31, 2007 and 2006, the Company recognized the net loss of 197,265 million (US$210,259 thousand) and

226,624 million (US$241,552 thousand), respectively, on valuation of the ineffective portion of such instruments and the other derivative

instruments in current operations.

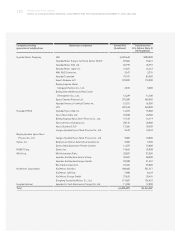

The Company entered into derivative instrument contracts with the settlement for the difference between the fair value and the contracted

initial price of the shares of Kia Motors Corporation as follows:

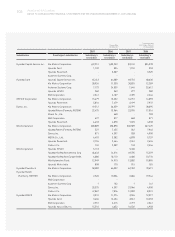

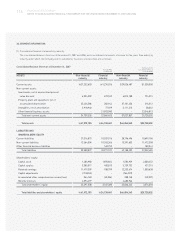

Contract Parties Derivatives Period Number of Initial price

Kia shares

Credit Suisse First Boston International Equity swap September 17, 2003 ~

September 8, 2008 12,145,598 US$ 8.2611

" Call option (*) " 12,145,598 US$ 11.5300

" Equity swap " 21,862,076 US$ 8.2611

JP Morgan Chase Bank, London Branch " " 1,839,367 US$ 7.8811

(*) The Company has the position of seller.

The gain or loss on valuation of these derivatives related to the fair value of Kia shares is recognized in current operations.

All premiums to be paid by the Company are recorded as accounts payable - other of 21,615 million (US$23,039 thousand) as of

December 31, 2007, and accounts payable-other of 21,524 million (US$ 22,942 thousand) and other non-current liabilities of 21,417

million (US$22,828 thousand) as of December 31, 2006, after deducting the present value discount of 2,703 million (US$2,881

thousand). Also, all premiums to be received by the Company are recorded as other current assets of 3,561 million (US$3,796

thousand) as of December 31, 2007, and other current assets of 3,529 million (US$3,761 thousand) and other assets of 3,529 million

(US$3,761 thousand) as of December 31, 2006 after deducting the present value discount of 448 million (US$478 thousand).

The Company recorded total gain on valuation of outstanding derivatives and present value of premiums to be paid of 114,248 million

(US$121,774 thousand) and 290,925 million (US$310,088 thousand) in current and non-current derivative assets as of December 31,

2007 and 2006, respectively. Also, total loss on valuation of outstanding derivatives and present value of premiums to be received of

161,850 million (US$172,511 thousand) and 55,506 million (US$59,162 thousand) is recorded in current and non-current derivative

liabilities as of December 31, 2007 and 2006, respectively.