Hyundai 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

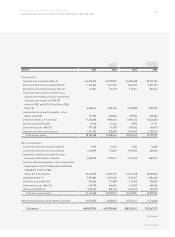

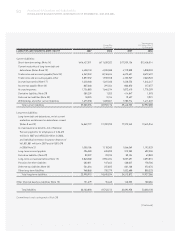

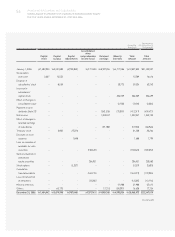

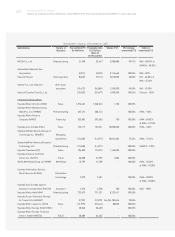

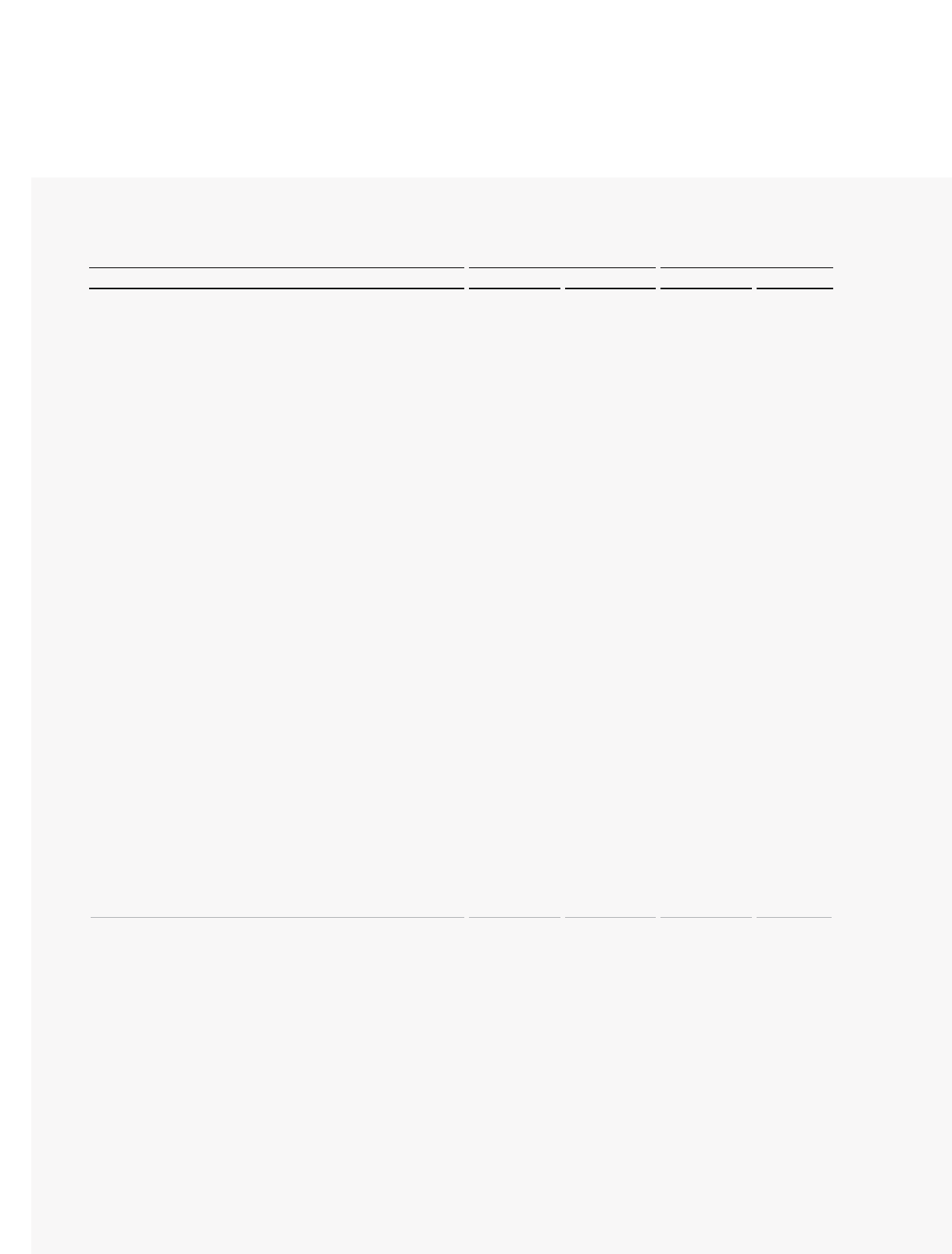

56 HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2007 AND 2006

2007 2006 2007 2006

Cash flows from operating activities:

Net income 1,600,480 1,259,247 $1,705,905 $1,342,195

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation 2,088,960 2,317,028 2,226,562 2,469,653

Amortization of intangibles 697,473 661,183 743,416 704,736

Bad debt expenses 127,020 324,855 135,387 346,253

Loss (gain) on foreign exchange translation, net 147,037 (208,230) 156,722 (221,946)

Gain on valuation of investment securities

accounted for using the equity method, net (203,536) (191,567) (216,943) (204,186)

Gain on disposal of investment securities

accounted for using the equity method (4,484) (38,606) (4,779) (41,149)

Loss on valuation of derivatives, net 25,295 467,578 26,961 498,378

Loss on disposal of trade notes and

accounts receivable 245,164 222,528 261,313 237,186

Loss on disposal of property,

plant and equipment, net 11,706 48,537 12,477 51,734

Gain on disposal of short-term investment

securities, net (30,621) (17,624) (32,638) (18,785)

Gain on disposal of long-term investment

securities, net (35,959) (195,922) (38,328) (208,828)

Provision for severance benefits 674,011 734,090 718,409 782,445

Amortization of discount on debentures 2,841 24,528 3,028 26,144

Impairment loss on intangibles 1,114 25,026 1,187 26,674

Provision for accrued warranties 647,470 583,778 690,119 622,232

Loss on impairment of investment securities 1,964 72,114 2,093 76,865

Impairment loss on property, plant and equipment 79 56,379 84 60,093

Minority interests, gain 355,607 51,988 379,031 55,412

Other 196,600 43,766 209,550 46,649

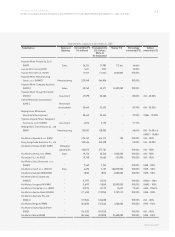

(Continued)

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)