Home Depot 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(4)

2004

2003

2002

2001

(1)

2000

1999

1998

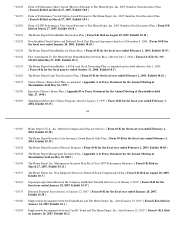

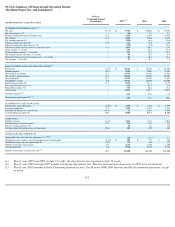

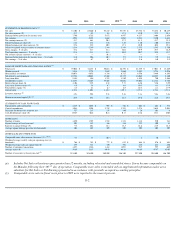

STATEMENT OF EARNINGS DATA

(2)

Net sales

$

71,100

$

63,660

$

58,247

$

53,553

$

45,738

$

38,434

$

30,219

Net sales increase (%)

11.7

9.3

8.8

17.1

19.0

27.2

25.1

Earnings before provision for income taxes

7,790

6,762

5,872

4,957

4,217

3,804

2,654

Net earnings

4,922

4,253

3,664

3,044

2,581

2,320

1,614

Net earnings increase (%)

15.7

16.1

20.4

17.9

11.3

43.7

31.9

Diluted earnings per share ($)

2.22

1.86

1.56

1.29

1.10

1.00

0.71

Diluted earnings per share increase (%)

19.4

19.2

20.9

17.3

10.0

40.8

29.1

Diluted weighted average number of common shares

2,216

2,289

2,344

2,353

2,352

2,342

2,320

Gross margin

–

%

of sales

33.4

31.7

31.1

30.2

29.9

29.7

28.5

Total operating expenses

–

%

of sales

22.4

21.1

21.1

20.9

20.7

19.8

19.7

Net interest expense (income)

–

%

of sales

—

—

(

0.1

)

—

—

—

—

Earnings before provision for income taxes

–

%

of sales

11.0

10.6

10.1

9.3

9.2

9.9

8.8

Net earnings

–

%

of sales

6.9

6.7

6.3

5.7

5.6

6.0

5.3

BALANCE SHEET DATA AND FINANCIAL RATIOS

(3)

Total assets

$

39,020

$

34,437

$

30,011

$

26,394

$

21,385

$

17,081

$

13,465

Working capital

3,818

3,774

3,882

3,860

3,392

2,734

2,076

Merchandise inventories

10,076

9,076

8,338

6,725

6,556

5,489

4,293

Net property and equipment

22,726

20,063

17,168

15,375

13,068

10,227

8,160

Long

-

term debt

2,148

856

1,321

1,250

1,545

750

1,566

Stockholders' equity

24,158

22,407

19,802

18,082

15,004

12,341

8,740

Book value per share ($)

11.06

9.93

8.38

7.71

6.46

5.36

3.95

Long

-

term debt

-

to

-

equity (%)

8.9

3.8

6.7

6.9

10.3

6.1

17.9

Total debt

-

to

-

equity (%)

8.9

6.1

6.7

6.9

10.3

6.1

17.9

Current ratio

1.37:1

1.40:1

1.48:1

1.59:1

1.77:1

1.75:1

1.73:1

Inventory turnover

(2)

4.9x

5.0x

5.3x

5.4x

5.1x

5.4x

5.4x

Return on invested capital (%)

(2)

19.9

19.2

18.8

18.3

19.6

22.5

19.3

STATEMENT OF CASH FLOWS DATA

Depreciation and amortization

$

1,319

$

1,076

$

903

$

764

$

601

$

463

$

373

Capital expenditures

3,948

3,508

2,749

3,393

3,574

2,618

2,094

Payments for businesses acquired, net

727

215

235

190

26

101

6

Cash dividends per share ($)

0.325

0.26

0.21

0.17

0.16

0.11

0.08

STORE DATA

Number of stores

1,890

1,707

1,532

1,333

1,134

930

761

Square footage at fiscal year

-

end

201

183

166

146

123

100

81

Increase in square footage (%)

9.8

10.2

14.1

18.5

22.6

23.5

22.8

Average square footage per store (in thousands)

106

107

108

109

108

108

107

STORE SALES AND OTHER DATA

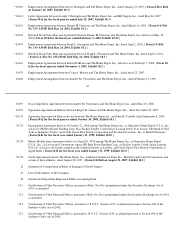

Comparable store sales increase (decrease) (%)

(4)(5)

5.1

3.7

(0.5

)

—

4

10

7

Weighted average weekly sales per operating store (in

thousands)

$

766

$

763

$

772

$

812

$

864

$

876

$

844

Weighted average sales per square foot ($)

375

371

370

394

415

423

410

Number of customer transactions

1,295

1,246

1,161

1,091

937

797

665

Average ticket ($)

54.89

51.15

49.43

48.64

48.65

47.87

45.05

Number of associates at fiscal year

-end

(3)

323,100

298,800

280,900

256,300

227,300

201,400

156,700

Includes Net Sales at locations open greater than 12 months, including relocated and remodeled stores. Stores become comparable on

the Monday following their 365

th

day of operation. Comparable store sales is intended only as supplemental information and is not a

substitute for Net Sales or Net Earnings presented in accordance with generally accepted accounting principles.

(5)

Comparable store sales in fiscal years prior to 2002 were reported to the nearest percent.

F-2