Home Depot 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

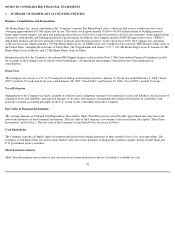

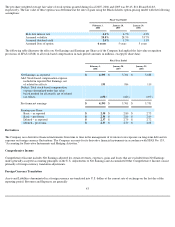

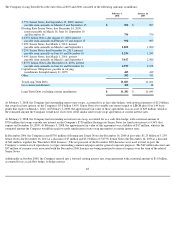

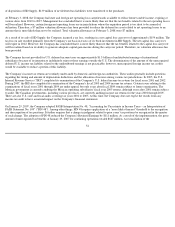

The Company's Long-Term Debt at the end of fiscal 2007 and 2006 consisted of the following (amounts in millions):

At February 3, 2008, the Company had outstanding interest rate swaps, accounted for as fair value hedges, with notional amounts of $2.0 billion

that swap fixed rate interest on the Company's $3.0 billion 5.40% Senior Notes for variable rate interest equal to LIBOR plus 60 to 149 basis

points that expire on March 1, 2016. At February 3, 2008, the approximate fair value of these agreements was an asset of $29 million, which is

the estimated amount the Company would have received to settle similar interest rate swap agreements at current interest rates.

At February 3, 2008, the Company had outstanding an interest rate swap, accounted for as a cash flow hedge, with a notional amount of

$750 million that swaps variable rate interest on the Company's $750 million floating rate Senior Notes for fixed rate interest at 4.36% that

expires on December 16, 2009. At February 3, 2008, the approximate fair value of this agreement was a liability of $17 million, which is the

estimated amount the Company would have paid to settle similar interest rate swap agreements at current interest rates.

In December 2006, the Company issued $750 million of floating rate Senior Notes due December 16, 2009 at par value, $1.25 billion of 5.25%

Senior Notes due December 16, 2013 at a discount of $7 million and $3.0 billion of 5.875% Senior Notes due December 16, 2036 at a discount

of $42 million, together the "December 2006 Issuance." The net proceeds of the December 2006 Issuance were used to fund, in part, the

Company's common stock repurchases, to repay outstanding commercial paper and for general corporate purposes. The $49 million discount and

$37 million of issuance costs associated with the December 2006 Issuance are being amortized to interest expense over the term of the related

Senior Notes.

Additionally in October 2006, the Company entered into a forward starting interest rate swap agreement with a notional amount of $1.0 billion,

accounted for as a cash flow hedge, to hedge interest

48

February 3,

2008

January 28,

2007

3.75% Senior Notes; due September 15, 2009; interest

payable semi

-

annually on March 15 and September 15

$

998

$

997

Floating Rate Senior Notes; due December 16, 2009;

interest payable on March 16, June 16, September 16

and December 16

750

750

4.625% Senior Notes; due August 15, 2010; interest

payable semi

-

annually on February 15 and August 15

998

997

5.20% Senior Notes; due March 1, 2011; interest

payable semi

-

annually on March 1 and September 1

1,000

1,000

5.25% Senior Notes; due December 16, 2013; interest

payable semi

-

annually on June 16 and December 16

1,244

1,243

5.40% Senior Notes; due March 1, 2016; interest

payable semi

-

annually on March 1 and September 1

3,017

2,986

5.875% Senior Notes; due December 16, 2036; interest

payable semi

-

annually on June 16 and December 16

2,959

2,958

Capital Lease Obligations; payable in varying

installments through January 31, 2055

415

419

Other

302

311

Total Long

-

Term Debt

11,683

11,661

Less current installments

300

18

Long

-

Term Debt, excluding current installments

$

11,383

$

11,643