Home Depot 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

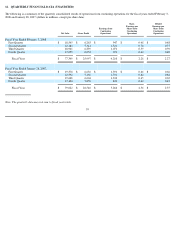

stock options also include performance options which vest on the later of the first anniversary date of the grant and the date the closing price of

the Company's common stock has been 25% greater than the exercise price of the options for 30 consecutive trading days. The Company

recognized $61 million, $148 million and $117 million of stock-

based compensation expense in fiscal 2007, 2006 and 2005, respectively, related

to stock options.

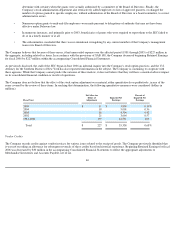

Under the Plans, as of February 3, 2008, the Company had issued 16 million shares of restricted stock, net of cancellations (the restrictions on

5 million shares have lapsed). Generally, the restrictions on the restricted stock lapse according to one of the following schedules: (1) the

restrictions on 100% of the restricted stock lapse at 3, 4 or 5 years, (2) the restrictions on 25% of the restricted stock lapse upon the third and

sixth year anniversaries of the date of issuance with the remaining 50% of the restricted stock lapsing upon the associate's attainment of age 62,

or (3) the restrictions on 25% of the restricted stock lapse upon the third and sixth year anniversaries of the date of issuance with the remaining

50% of the restricted stock lapsing upon the earlier of the associate's attainment of age 60 or the tenth anniversary date. The restricted stock also

includes the Company's performance shares, the payout of which is dependent on the Company's total shareholders return percentile ranking

compared to the performance of individual companies included in the S&P 500 index at the end of the three-year performance cycle.

Additionally, certain awards may become non-forfeitable upon the attainment of age 60, provided the associate has had five years of continuous

service. The fair value of the restricted stock is expensed over the period during which the restrictions lapse. The Company recorded stock-

based

compensation expense related to restricted stock of $122 million, $95 million and $32 million in fiscal 2007, 2006 and 2005, respectively.

In fiscal 2007, 2006 and 2005, there were 593,000, 417,000 and 461,000 deferred shares, respectively, granted under the Plans. Each deferred

share entitles the associate to one share of common stock to be received up to five years after the vesting date of the deferred shares, subject to

certain deferral rights of the associate. The Company recorded stock-based compensation expense related to deferred shares of $10 million,

$37 million and $10 million in fiscal 2007, 2006 and 2005, respectively.

As of February 3, 2008, there were 2.5 million non-qualified stock options outstanding under non-

qualified stock option plans that are not part of

the Plans.

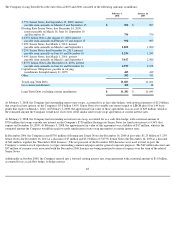

The Company maintains two ESPPs (U.S. and non-U.S. plans). The plan for U.S. associates is a tax-qualified plan under Section 423 of the

Internal Revenue Code. The non-U.S. plan is not a Section 423 plan. The ESPPs allow associates to purchase up to 152 million shares of

common stock, of which 128 million shares have been purchased from inception of the plans. The purchase price of shares under the ESPPs is

equal to 85% of the stock's fair market value on the last day of the purchase period. During fiscal 2007, there were 3 million shares purchased

under the ESPPs at an average price of $28.25. Under the outstanding ESPPs as of February 3, 2008, employees have contributed $8 million to

purchase shares at 85% of the stock's fair market value on the last day (June 30, 2008) of the purchase period. The Company had 24 million

shares available for issuance under the ESPPs at February 3, 2008. The Company recognized $14 million, $17 million and $16 million of stock-

based compensation in fiscal 2007, 2006 and 2005, respectively, related to the ESPPs.

In total, the Company recorded stock-based compensation expense, including the expense of stock options, ESPPs, restricted stock and deferred

stock units, of $207 million, $297 million and $175 million, in fiscal 2007, 2006 and 2005, respectively.

54