Home Depot 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

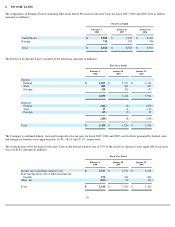

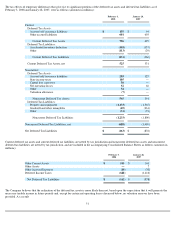

8. LEASES

The Company leases certain retail locations, office space, warehouse and distribution space, equipment and vehicles. While most of the leases

are operating leases, certain locations and equipment are leased under capital leases. As leases expire, it can be expected that, in the normal

course of business, certain leases will be renewed or replaced.

Certain lease agreements include escalating rents over the lease terms. The Company expenses rent on a straight-line basis over the life of the

lease which commences on the date the Company has the right to control the property. The cumulative expense recognized on a straight-line

basis in excess of the cumulative payments is included in Other Accrued Expenses and Other Long-Term Liabilities in the accompanying

Consolidated Balance Sheets.

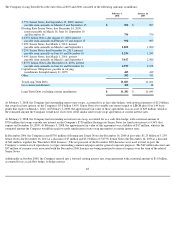

The Company has a lease agreement under which the Company leases certain assets totaling $282 million. This lease was originally created

under a structured financing arrangement and involves two special purpose entities. The Company financed a portion of its new stores opened in

fiscal years 1997 through 2003 under this lease agreement. Under this agreement, the lessor purchased the properties, paid for the construction

costs and subsequently leased the facilities to the Company. The Company records the rental payments under the terms of the operating lease

agreements as SG&A in the accompanying Consolidated Statements of Earnings.

The $282 million lease agreement expires in fiscal 2008 with no renewal option. The lease provides for a substantial residual value guarantee

limited to 79% of the initial book value of the assets and includes a purchase option at the original cost of each property. During fiscal 2005, the

Company committed to exercise its option to purchase the assets under this lease for $282 million at the end of the lease term in fiscal 2008.

In the first quarter of fiscal 2004, the Company adopted the revised version of FASB Interpretation No. 46(R), "Consolidation of Variable

Interest Entities" ("FIN 46"). FIN 46 requires consolidation of a variable interest entity if a company's variable interest absorbs a majority of the

entity's expected losses or receives a majority of the entity's expected residual returns, or both. In accordance with FIN 46, the Company was

required to consolidate one of the two aforementioned special purpose entities that, before the effective date of FIN 46, met the requirements for

non-consolidation. The second special purpose entity that owns the assets leased by the Company totaling $282 million is not owned by or

affiliated with the Company, its management or its officers. Pursuant to FIN 46, the Company was not deemed to have a variable interest, and

therefore was not required to consolidate this entity.

FIN 46 requires the Company to measure the assets and liabilities at their carrying amounts, which amounts would have been recorded if FIN 46

had been effective at the inception of the transaction. Accordingly, during the first quarter of fiscal 2004, the Company recorded Long-Term

Debt of $282 million and Long-

Term Notes Receivable of $282 million on the Consolidated Balance Sheets. During fiscal 2007, the liability was

reclassified to Current Installments of Long-Term Debt as it is due in fiscal 2008. The Company continues to record the rental payments under

the operating lease agreements as SG&A in the Consolidated Statements of Earnings. The adoption of FIN 46 had no economic impact on the

Company.

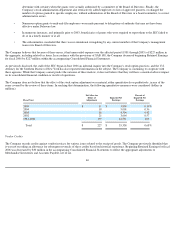

Total rent expense, net of minor sublease income for fiscal 2007, 2006 and 2005 was $824 million, $768 million and $720 million, respectively.

Certain store leases also provide for contingent rent payments based on percentages of sales in excess of specified minimums. Contingent rent

expense for fiscal 2007, 2006 and 2005 was approximately $6 million, $9 million and $9 million, respectively. Real estate taxes, insurance,

maintenance and operating expenses applicable to the leased property are obligations of the Company under the lease agreements.

56