Home Depot 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

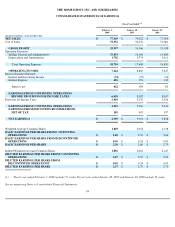

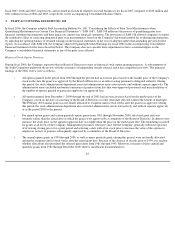

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business, Consolidation and Presentation

The Home Depot, Inc. and its subsidiaries (the "Company") operate The Home Depot stores, which are full-service, warehouse-style stores

averaging approximately 105,000 square feet in size. The stores stock approximately 35,000 to 45,000 different kinds of building materials,

home improvement supplies and lawn and garden products that are sold to do-it-yourself customers, do-it-for-me customers, home improvement

contractors, tradespeople and building maintenance professionals. In addition, the Company operates EXPO Design Center stores ("EXPO"),

which offer products and services primarily related to design and renovation projects. At the end of fiscal 2007, the Company was operating

2,234 stores in total, which included 1,950 The Home Depot stores, 34 EXPO stores, five Yardbirds stores and two THD Design Center stores in

the United States, including the territories of Puerto Rico, the Virgin Islands and Guam ("U.S."), 165 The Home Depot stores in Canada, 66 The

Home Depot stores in Mexico and 12 The Home Depot stores in China.

Information related to the Company's discontinued HD Supply business is discussed in Note 2. The Consolidated Financial Statements include

the accounts of the Company and its wholly-owned subsidiaries. All significant intercompany transactions have been eliminated in

consolidation.

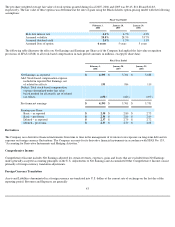

Fiscal Year

The Company's fiscal year is a 52- or 53-week period ending on the Sunday nearest to January 31. Fiscal year ended February 3, 2008 ("fiscal

2007") includes 53 weeks and fiscal years ended January 28, 2007 ("fiscal 2006") and January 29, 2006 ("fiscal 2005") include 52 weeks.

Use of Estimates

Management of the Company has made a number of estimates and assumptions relating to the reporting of assets and liabilities, the disclosure of

contingent assets and liabilities, and reported amounts of revenues and expenses in preparing these financial statements in conformity with

generally accepted accounting principles in the U.S. Actual results could differ from these estimates.

Fair Value of Financial Instruments

The carrying amounts of Cash and Cash Equivalents, Receivables, Short-Term Debt and Accounts Payable approximate fair value due to the

short-term maturities of these financial instruments. The fair value of the Company's investments is discussed under the caption "Short-Term

Investments" in this Note 1. The fair value of the Company's Long-Term Debt is discussed in Note 5.

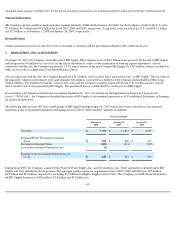

Cash Equivalents

The Company considers all highly liquid investments purchased with original maturities of three months or less to be cash equivalents. The

Company's Cash Equivalents are carried at fair market value and consist primarily of high-grade commercial paper, money market funds and

U.S. government agency securities.

Short-Term Investments

Short-Term Investments are recorded at fair value based on current market rates and are classified as available-for-sale.

38