Home Depot 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

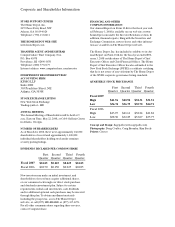

10

-

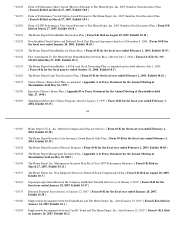

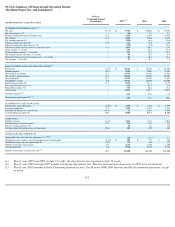

Year Summary of Financial and Operating Results

The Home Depot, Inc. and Subsidiaries

(1)

amounts in millions, except where noted

10-Year

Compound Annual

Growth Rate

2007

(1)

2006

2005

STATEMENT OF EARNINGS DATA

(2)

Net sales

12.3

%

$

77,349

$

79,022

$

77,019

Net sales increase (%)

—

(

2.1

)

2.6

8.3

Earnings before provision for income taxes

13.3

6,620

8,502

8,967

Net earnings

13.8

4,210

5,266

5,641

Net earnings increase (%)

—

(

20.1

)

(6.6

)

14.6

Diluted earnings per share ($)

15.9

2.27

2.55

2.63

Diluted earnings per share increase (%)

—

(

11.0

)

(3.0

)

18.5

Diluted weighted average number of common shares

(2.1

)

1,856

2,062

2,147

Gross margin

–

%

of sales

—

33.6

33.6

33.7

Total operating expenses

–

%

of sales

—

24.3

22.4

21.9

Net interest expense (income)

–

%

of sales

—

0.8

0.5

0.1

Earnings before provision for income taxes

–

%

of sales

—

8.6

10.8

11.6

Net earnings

–

%

of sales

—

5.4

6.7

7.3

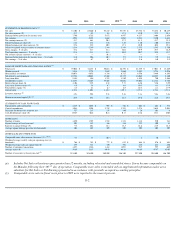

BALANCE SHEET DATA AND FINANCIAL RATIOS

(3)

Total assets

14.7

%

$

44,324

$

52,263

$

44,405

Working capital

(0.2

)

1,968

5,069

2,563

Merchandise inventories

12.5

11,731

12,822

11,401

Net property and equipment

15.5

27,476

26,605

24,901

Long

-

term debt

24.2

11,383

11,643

2,672

Stockholders' equity

9.6

17,714

25,030

26,909

Book value per share ($)

12.5

10.48

12.71

12.67

Long

-

term debt

-

to

-

equity (%)

—

64.3

46.5

9.9

Total debt

-

to

-

equity (%)

—

75.8

46.6

15.2

Current ratio

—

1.15:1

1.39:1

1.20:1

Inventory turnover

(2)

—

4.2x

4.5x

4.7x

Return on invested capital (%)

(2)

—

13.9

16.8

20.4

STATEMENT OF CASH FLOWS DATA

Depreciation and amortization

21.0

%

$

1,906

$

1,886

$

1,579

Capital expenditures

9.3

3,558

3,542

3,881

Payments for businesses acquired, net

(14.3

)

13

4,268

2,546

Cash dividends per share ($)

30.5

0.900

0.675

0.400

STORE DATA

Number of stores

13.6

%

2,234

2,147

2,042

Square footage at fiscal year

-

end

13.5

235

224

215

Increase in square footage (%)

—

4.9

4.2

7.0

Average square footage per store (in thousands)

(0.1

)

105

105

105

STORE SALES AND OTHER DATA

Comparable store sales increase (decrease) (%)

(4)(5)

—

(

6.7

)

(2.8

)

3.1

Weighted average weekly sales per operating store (in thousands)

(2.3

)%

$

658

$

723

$

763

Weighted average sales per square foot ($)

(2.0

)

332

358

377

Number of customer transactions

9.3

1,336

1,330

1,330

Average ticket ($)

2.8

57.48

58.90

57.98

Number of associates at fiscal year

-end

(3)

10.3

331,000

364,400

344,800

Fiscal years 2007 and 2001 include 53 weeks; all other fiscal years reported include 52 weeks.

(2) Fiscal years 2003 through 2007 include Continuing Operations only. The discontinued operations prior to 2003 were not material.

(3) Fiscal year 2007 amounts include Continuing Operations only. Fiscal years 1998-2006 amounts include discontinued operations, except

as noted.

F-1