Home Depot 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

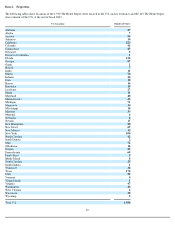

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

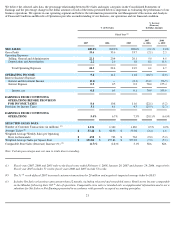

Executive Summary and Selected Consolidated Statements of Earnings Data

For fiscal year ended February 3, 2008 ("fiscal 2007"), we reported Net Earnings of $4.4 billion and Diluted Earnings per Share of $2.37

compared to Net Earnings of $5.8 billion and Diluted Earnings per Share of $2.79 for fiscal year ended January 28, 2007 ("fiscal 2006").

On August 30, 2007, we closed the sale of HD Supply. We received net proceeds of $8.3 billion for the sale of HD Supply and recognized a loss

of $4 million, net of tax, for the sale of the business. HD Supply is being reported as a discontinued operation in our Consolidated Statements of

Earnings for all periods presented.

We reported Earnings from Continuing Operations of $4.2 billion and Diluted Earnings per Share from Continuing Operations of $2.27 for fiscal

2007 compared to Earnings from Continuing Operations of $5.3 billion and Diluted Earnings per Share from Continuing Operations of $2.55 for

fiscal 2006. Net Sales decreased 2.1% to $77.3 billion for fiscal 2007 from $79.0 billion for fiscal 2006. Our gross profit margin was 33.6% and

our operating margin was 9.4% for fiscal 2007.

Fiscal 2007 consisted of 53 weeks compared with 52 weeks for fiscal 2006. The 53

rd

week added approximately $1.1 billion in Net Sales and

increased Diluted Earnings per Share from Continuing Operations by approximately $0.04 for fiscal 2007.

The slowdown in the residential construction and home improvement markets negatively affected our Net Sales for fiscal 2007. Our comparable

store sales declined 6.7% in fiscal 2007 driven by a 4.4% decline in comparable store customer transactions, as well as a 2.4% decline in our

average ticket to $57.48.

We believe the residential construction and home improvement market will remain soft in 2008. We expect our Net Sales to decline by 4% to

5% and our Diluted Earnings per Share from Continuing Operations to decline by approximately 19% to 24% for fiscal 2008.

We remain committed to the long-term health of our business through our strategy of investing in our retail business through the following five

key priorities:

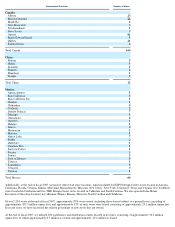

Associate Engagement – We have taken a number of actions to improve associate engagement by changing the way our associates are

compensated, recognized and rewarded, including restructuring our success sharing program, an incentive program for our hourly associates

driven by individual store performance. As of the end of fiscal 2007, 44% of our stores were eligible to receive a success sharing payout for the

second half of fiscal 2007 compared to 23% of stores for the same period last year. We also launched a program earlier this year to hire master

trade specialists to bring electrical and plumbing experience and know-how to the stores and to transfer knowledge to other associates. We now

have over 2,500 master trade specialists in our stores.

Product Excitement – In fiscal 2007, we accelerated clearance markdowns to sell through existing product in order to make room for new

merchandise as we launched our enhanced product line review process and in support of merchandising reset activities. We gained market share

in paint, appliances and power tools in fiscal 2007 through the addition of new styles and color choices and by enhancing our product displays.

In areas where we have completed our merchandising resets and implemented change from our product line review process, collectively these

categories are outperforming store sales performance in line with our expectations.

Shopping Environment – We continued our store reinvestment program by completing an aggressive list of maintenance projects, including new

lighting and basic clean-up activities for over half of our stores, as well as more complex repair and maintenance activities for hundreds of other

stores. In addition to programmatic maintenance, our integrated field and support center teams have rolled out store

19