Home Depot 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

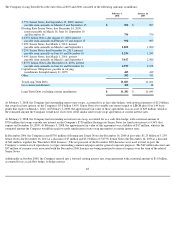

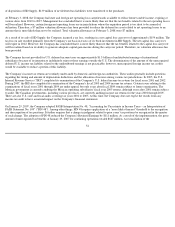

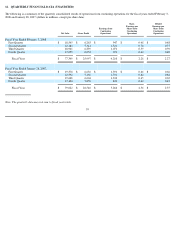

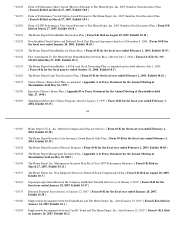

10. BASIC AND DILUTED WEIGHTED AVERAGE COMMON SHARES

The reconciliation of basic to diluted weighted average common shares for fiscal 2007, 2006 and 2005 is as follows (amounts in millions):

Stock plans include shares granted under the Company's employee stock plans as described in Note 7 to the Consolidated Financial Statements.

Options to purchase 43.4 million, 45.4 million and 55.1 million shares of common stock at February 3, 2008, January 28, 2007 and January 29,

2006, respectively, were excluded from the computation of Diluted Earnings per Share because their effect would have been anti-dilutive.

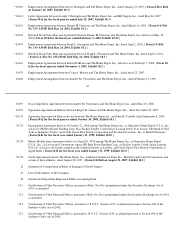

11. COMMITMENTS AND CONTINGENCIES

At February 3, 2008, the Company was contingently liable for approximately $730 million under outstanding letters of credit and open accounts

issued for certain business transactions, including insurance programs, trade contracts and construction contracts. The Company's letters of credit

are primarily performance-based and are not based on changes in variable components, a liability or an equity security of the other party.

The Company is a defendant in numerous cases containing class-action allegations in which the plaintiffs are current and former hourly

associates who allege that the Company forced them to work "off the clock" or failed to provide work breaks, or otherwise that they were not

paid for work performed. The complaints generally seek unspecified monetary damages, injunctive relief or both. Class or collective-action

certification has yet to be addressed in most of these cases. The Company cannot reasonably estimate the possible loss or range of loss which

may arise from these lawsuits. These matters, if decided adversely to or settled by the Company, individually or in the aggregate, may result in a

liability material to the Company's consolidated financial condition or results of operations. The Company is vigorously defending itself against

these actions.

58

Fiscal Year Ended

February 3,

2008

January 28,

2007

January 29,

2006

Weighted average common shares

1,849

2,054

2,138

Effect of potentially dilutive securities:

Stock Plans

7

8

9

Diluted weighted average common shares

1,856

2,062

2,147