Home Depot 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

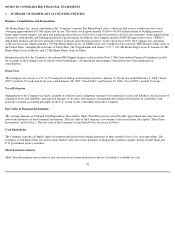

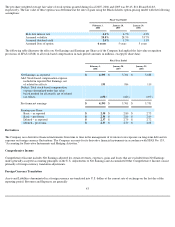

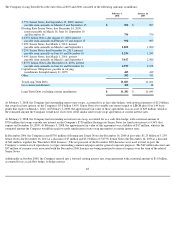

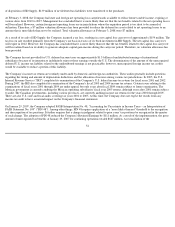

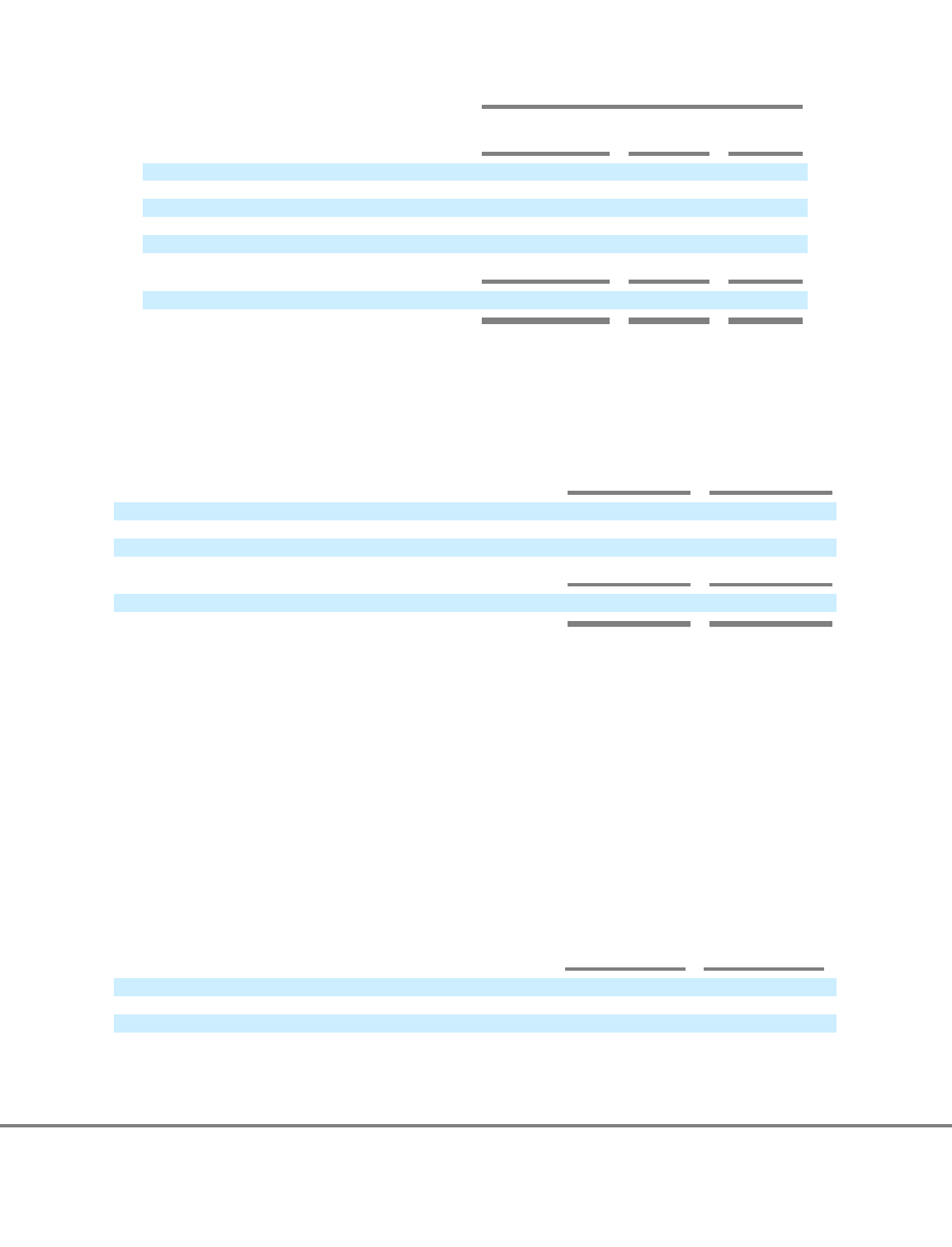

Impact of Adjustments

The impact of each of the items noted above, net of tax, on fiscal 2006 beginning balances are presented below (amounts in millions):

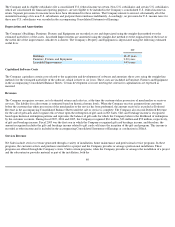

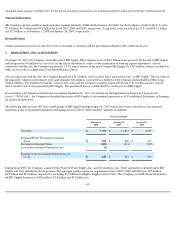

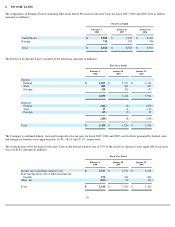

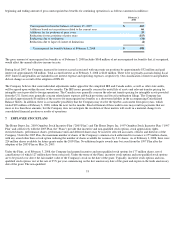

4. INTANGIBLE ASSETS

The Company's intangible assets at the end of fiscal 2007 and 2006, which are included in Other Assets in the accompanying Consolidated

Balance Sheets, consisted of the following (amounts in millions):

The decrease in intangible assets from January 28, 2007 to February 3, 2008 was a result of the sale of HD Supply. Amortization expense related

to intangible assets in continuing operations was $9 million, $10 million and less than $1 million for fiscal 2007, 2006 and 2005, respectively.

Estimated future amortization expense for intangible assets recorded as of February 3, 2008 is $8 million, $8 million, $8 million, $5 million and

$4 million for fiscal 2008 through fiscal 2012, respectively.

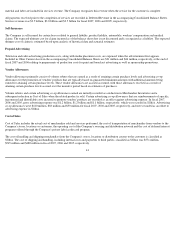

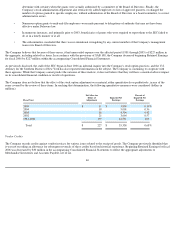

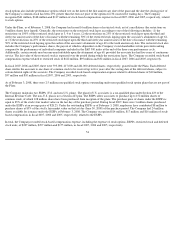

5. DEBT

The Company has commercial paper programs that allow for borrowings up to $3.25 billion. All of the Company's short-term borrowings in

fiscal 2007 and 2006 were under these commercial paper programs. In connection with the commercial paper programs, the Company has a

back-up credit facility with a consortium of banks for borrowings up to $3.0 billion. The credit facility, which expires in December 2010,

contains various restrictions, none of which is expected to materially impact the Company's liquidity or capital resources.

Short-Term Debt under the commercial paper program was as follows (dollars in millions):

47

Cumulative Effect as of January 30, 2006

Stock Option

Practices

Vendor

Credits

Total

Merchandise Inventories

$

—

$

9

$

9

Accounts Payable

—

(

59

)

(59

)

Deferred Income Taxes

11

20

31

Other Accrued Expenses

(37

)

—

(

37

)

Paid

-

In Capital

(201

)

—

(

201

)

Retained Earnings

227

30

257

Total

$

—

$

—

$

—

February 3,

2008

January 28,

2007

Customer relationships

$

11

$

756

Trademarks and franchises

83

106

Other

29

67

Less accumulated amortization

(23

)

(151

)

Total

$

100

$

778

February 3,

2008

January 28,

2007

Balance outstanding at fiscal year

-

end

$

1,747

$

—

Maximum amount outstanding at any month

-

end

$

1,747

$

1,470

Average daily short

-

term borrowings

$

526

$

300

Weighted average interest rate

5.0

%

5.1

%