Home Depot 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

translated using average exchange rates for the period and equity transactions are translated using the actual rate on the day of the transaction.

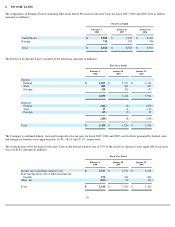

Segment Information

The Company operates within a single operating segment primarily within North America. Net Sales for the Company outside of the U.S. were

$7.4 billion, $6.3 billion and $5.2 billion for fiscal 2007, 2006 and 2005, respectively. Long-lived assets outside of the U.S. totaled $3.1 billion

and $2.5 billion as of February 3, 2008 and January 28, 2007, respectively.

Reclassifications

Certain amounts in prior fiscal years have been reclassified to conform with the presentation adopted in the current fiscal year.

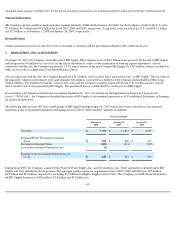

2. DISPOSITION AND ACQUISITIONS

On August 30, 2007, the Company closed the sale of HD Supply. The Company received $8.3 billion of net proceeds for the sale of HD Supply

and recognized a $4 million loss, net of tax, on the sale of the business, subject to the finalization of working capital adjustments. Also in

connection with the sale, the Company purchased a 12.5% equity interest in the newly formed HD Supply for $325 million, which is included in

Other Assets in the accompanying Consolidated Balance Sheets.

Also in connection with the sale, the Company guaranteed a $1.0 billion senior secured loan ("guaranteed loan") of HD Supply. The fair value of

the guarantee, which was determined to be approximately $16 million, is recorded as a liability of the Company and included in Other Long-

Term Liabilities. The guaranteed loan has a term of five years and the Company would be responsible for up to $1.0 billion and any unpaid

interest in the event of non-payment by HD Supply. The guaranteed loan is collateralized by certain assets of HD Supply.

In accordance with Statement of Financial Accounting Standards No. 144, "Accounting for the Impairment or Disposal of Long-Lived

Assets" ("SFAS 144"), the Company reclassified the results of HD Supply as discontinued operations in its Consolidated Statements of Earnings

for all periods presented.

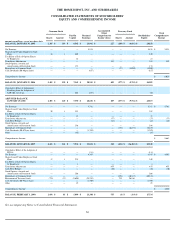

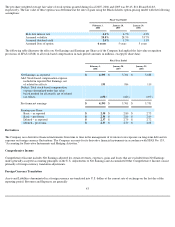

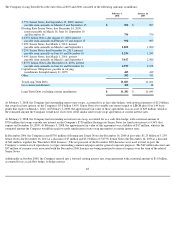

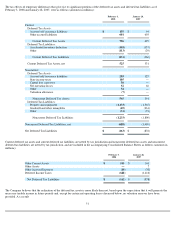

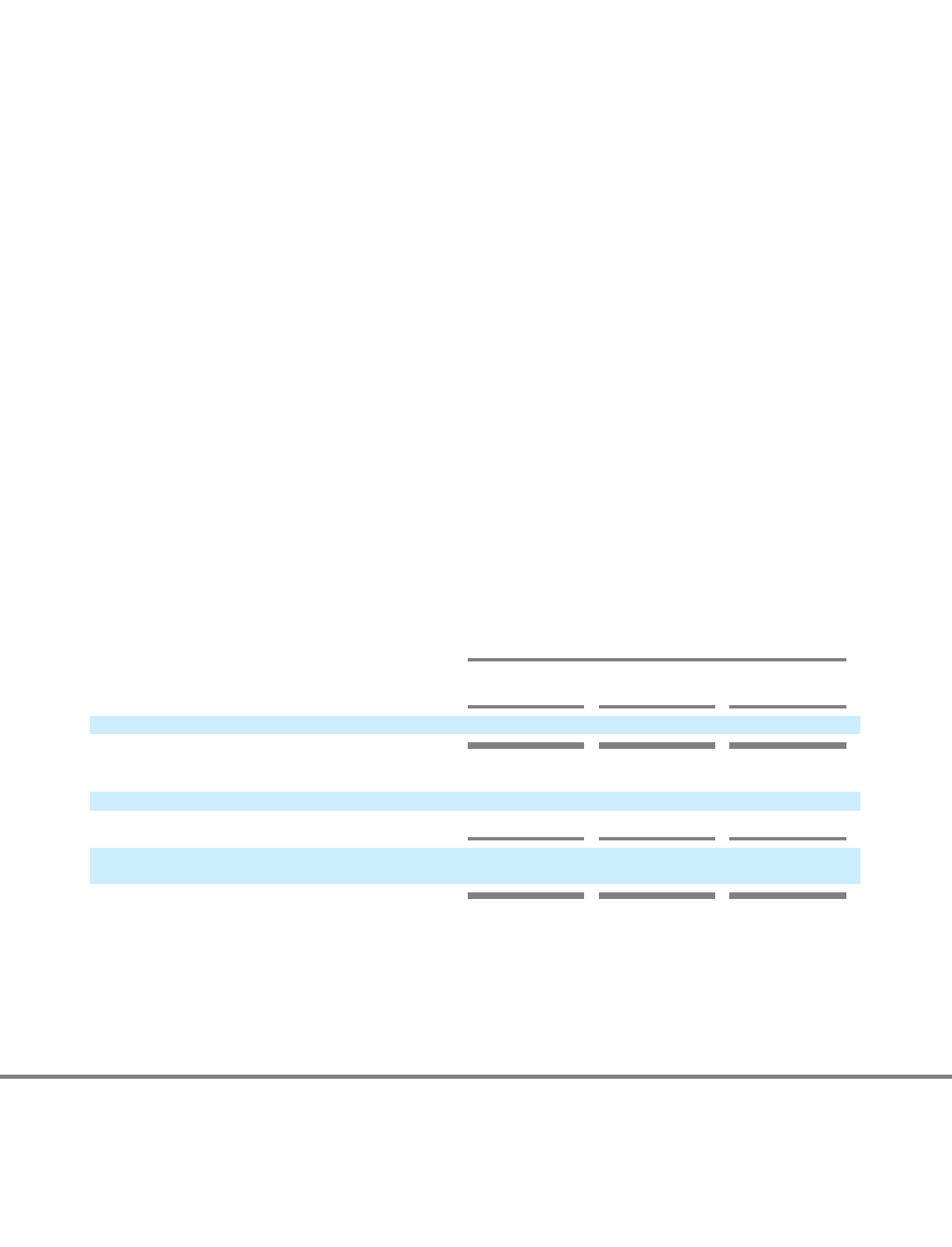

The following table presents Net Sales and Earnings of HD Supply through August 30, 2007 which have been reclassified to discontinued

operations in the Consolidated Statements of Earnings for fiscal 2007, 2006 and 2005 (amounts in millions):

During fiscal 2007, the Company acquired Ohio Water & Waste Supply, Inc. and Geosynthetics, Inc. These acquisitions operated under HD

Supply and were included in the disposition. The aggregate purchase price for acquisitions in fiscal 2007, 2006 and 2005 was $25 million,

$4.5 billion and $2.6 billion, respectively, including $3.5 billion for Hughes Supply in fiscal 2006. The Company recorded Goodwill related to

the HD Supply businesses of $20 million, $2.8 billion and $1.8 billion for

44

Fiscal Year Ended

February 3,

2008

January 28,

2007

January 29,

2006

Net Sales

$

7,391

$

11,815

$

4,492

Earnings Before Provision for Income

Taxes

$

291

$

806

$

315

Provision for Income Taxes

(102

)

(311

)

(118

)

Loss on Discontinued Operations, net

(4

)

—

—

Earnings from Discontinued Operations, net

of tax

$

185

$

495

$

197