Frontier Airlines 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

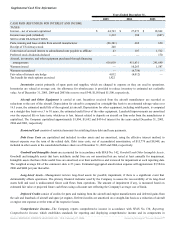

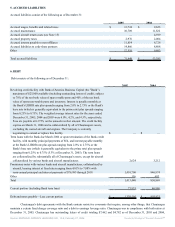

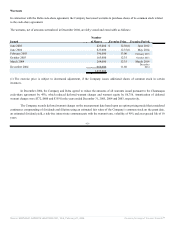

5. ACCRUED LIABILITIES

Accrued liabilities consist of the following as of December 31:

2005 2004

Accrued wages, benefits and related taxes $ 13,724 $ 9,623

Accrued maintenance 10,709 11,822

Accrued aircraft return costs (see Note 15) — 4,599

Accrued property taxes 2,976 2,004

Accrued interest payable to non-affiliates 11,854 6,726

Accrued liabilities to code-share partners 14,866 8,808

Other 17,519 9,803

Total accrued liabilities $ 71,648 $ 53,385

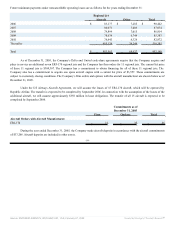

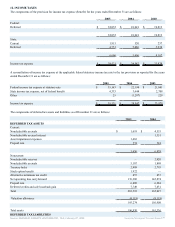

6. DEBT

Debt consists of the following as of December 31:

2005 2004

Revolving credit facility with Bank of America Business Capital (the "Bank"),

maximum of $25,000 available (including outstanding letters of credit), subject

to 70% of the net book value of spare rotable parts and 40% of the net book

value of spare non-rotable parts and inventory. Interest is payable monthly at

the Bank's LIBOR rate plus spreads ranging from 2.0% to 2.75% or the Bank's

base rate (which is generally equivalent to the prime rate) plus spreads ranging

from 0.25% to 0.75%. The weighted average interest rates for the years ended

December 31, 2005, 2004 and 2003 were 6.0%, 4.2%, and 4.5%, respectively.

Fees are payable at 0.375% on the unused revolver amount. The credit facility

expires on March 31, 2006 and is collateralized by all of Chautauqua's assets,

excluding the owned aircraft and engines. The Company is currently

negotiating to extend or replace this facility.

$ — $ —

Term loans with the Bank due March 2006 or upon termination of the Bank credit

facility, with monthly principal payments of $54, and interest payable monthly

at the Bank's LIBOR rate plus spreads ranging from 2.0% to 2.75% or the

Bank's base rate (which is generally equivalent to the prime rate) plus spreads

ranging from 0.25% to 0.75% (5.3% at December 31, 2005). The term loans

are collateralized by substantially all of Chautauqua's assets, except for aircraft

collateralized by various banks and aircraft manufacturer.

2,624 3,212

Promissory notes with various banks and aircraft manufacturer, collateralized by

aircraft, bearing interest at fixed rates ranging from 4.01% to 7.08% with

semi-annual principal and interest payments of $76,983 through 2019.

1,410,700

846,974

Other 116 683

Total 1,413,440 850,869

Current portion (including Bank term loan) 73,935 46,986

Debt and notes payable—Less current portion $ 1,339,505 $ 803,833

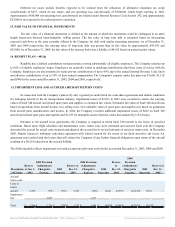

Chautauqua's debt agreements with the Bank contain restrictive covenants that require, among other things, that Chautauqua

maintain a certain fixed charge coverage ratio and a debt to earnings leverage ratio. Chautauqua was in compliance with both ratios at

December 31, 2005. Chautauqua has outstanding letters of credit totaling $7,462 and $4,782 as of December 31, 2005 and 2004,

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠