Frontier Airlines 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

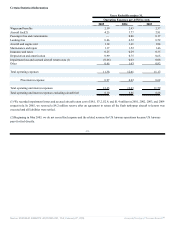

Liquidity and Capital Resources

Prior to June 2004, we had used internally generated funds and third-party financing to meet our working capital and capital

expenditure requirements. In June 2004, we completed our initial public common stock offering, which provided approximately

$58.2 million, net of offering expenses and before the repayment of debt. In addition, we completed follow-on offerings in February

and July 2005, which provided approximately $186.8 million of proceeds, net of offering expenses. As a result of our code-share

agreements with US Airways and Delta., which require us to significantly increase our fleet of regional jets, we will significantly

increase our cash requirements for debt service and lease payments.

As of December 31, 2005, we had $162.0 million in cash and $14.9 million available under our revolving credit facility. At

December 31, 2005, we had working capital surplus of $57.2 million.

Chautauqua has a credit facility with Bank of America Business Capital which provides for a $25.0 million revolving credit

facility. The revolving credit facility allows Chautauqua to borrow up to 70% of the lower of net book value or appraised orderly

liquidation value of spare rotable parts and up to 40% of the lower of net book value or appraised orderly liquidation value of spare

non-rotable parts for our regional jet fleet. The revolving credit facility is collateralized by all of Chautauqua's assets, excluding the

owned aircraft and engines. Borrowings under the credit facility bear interest at a rate equal to, at Chautauqua's option, LIBOR plus

spreads ranging from 2.0% to 2.75% or the bank's base rate (which is generally equivalent to the prime rate) plus spreads ranging from

0.25% to 0.75%. Chautauqua pays an annual commitment fee on the unused portion of the revolving credit facility in an amount equal

to 0.375% of the unused amounts. The credit facility limits Chautauqua's ability to incur indebtedness or create or incur liens on our

assets. In addition, the credit facility requires Chautauqua to maintain a specified fixed charge coverage ratio and a debt to earnings

leverage ratio. Chautauqua was in compliance with both ratios at December 31, 2005. This credit facility expires March 31, 2006 and

we are negotiating to extend or replace the facility.

At December 31, 2005, Chautauqua had $7.5 million of outstanding letters of credit. At December 31, 2005 we had $2.6

million outstanding under a term loan. The proceeds of the term loan were obtained in December 2004 for a GE engine purchased in

October 2004. The loan is payable in monthly principal installments of $53,543 through March 2006 with the remaining balance due

March 31, 2006. The $2.6 million is classified as a current liability on the balance sheet.

As of December 31, 2005, we leased nine spare regional jet engines from General Electric Capital Aviation Services and

five spare regional jet engines from RRPF Engine Leasing (US) LLC.

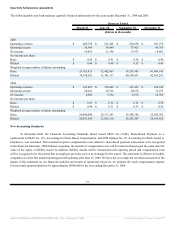

Net cash from operating activities was $91.6 million, $116.8 million and $170.9 million for the years ended December 31,

2003, 2004 and 2005, respectively. The increase from operating activities is primarily due to the continued growth of our business. For

2005, net cash from operating activities is primarily net income of $60.7 million, depreciation and amortization of $68.0 million, the

change in deferred income taxes of $37.6 million and the increase in accrued liabilities of $29.0 million. For 2004, net cash from

operating activities is primarily net income of $38.9 million, depreciation and amortization of $37.1 million, the change in deferred

income taxes of $24.0 million and the increase in accounts payable and other current liabilities of $13.3 million. For 2003, net cash

from operating activities consisted primarily of net income of $36.1 million, depreciation and amortization of $26.2 million, the

change in deferred income taxes of $23.7 million, a non-cash charge for impairment loss and accrued aircraft return costs of

$2.8 million and an increase in current accrued liabilities of $14.9 million partially offset by increases in receivables and other assets

of $(7.8) million..

Net cash from investing activities was $(30.7) million, $(102.4) million and $(175.2) for the years ended December 31, 2003,

2004 and 2005, respectively. In 2005, we purchased 35 Embraer regional jets and paid $51.6 million for commuter slots. In 2004, we

purchased 24 Embraer regional jets and our net aircraft deposits totaled $38.8 million. In 2003, we purchased 20 Embraer regional

jets, $4.3 million of spare parts, $2.4 million in aircraft leasehold improvements and $1.1 million of maintenance equipment.

Net cash from financing activities was $(45.1) million, $9.3 million and $120.1 million for the years ended December 31,

2003, 2004 and 2005, respectively. In 2005 we completed two follow on public stock offering providing $186.8 million and made debt

payments of $53.4 million. For 2004, we made debt payments and payments to the debt sinking fund of $26.9 million. Our net cash

from financing activities included $58.2 million net cash received from our initial stock offering in June 2004. We used $20.4 million

to repay WexAir LLC for indebtedness we originally incurred in May 1998 to finance a portion of our purchase of Chautauqua. In

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠