Frontier Airlines 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

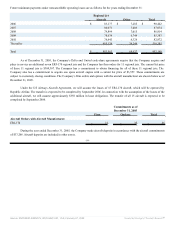

Risk Management—The Company accounts for derivatives in accordance with SFAS No. 133, Accounting for Derivative

Instruments and Hedging Activities, as amended and interpreted. Fuel swaps were not designated as hedging instruments and,

accordingly, were carried at fair value in prepaid expenses and other current assets or accrued liabilities with gains and losses recorded

in other income.

During 2004 in anticipation of financing the purchase of regional jet aircraft on firm order with the manufacturer, the

Company entered into fourteen treasury lock agreements with notional amounts totaling $373,500 and a weighted average interest rate

of 4.47% with expiration dates through June 2005. Management designated the treasury lock agreements as cash flow hedges of

forecasted transactions. The treasury lock agreements were settled at each respective settlement date, which were the purchase dates of

the respective aircraft. The Company settled seven agreements during each of the years ended December 31, 2004 and 2005. The net

amount paid was $2,969 and $4,502 in 2004 and 2005, respectively, and was recorded in accumulated other comprehensive loss, net

of tax. Of these amounts, the Company reclassified $21 and $286 to interest expense for the years ended December 31, 2004 and

2005, respectively. The Company expects to reclassify $299 to interest expense for the year ending December 31, 2006. Amounts are

amortized to interest expense over the terms of the respective aircraft debt. All treasury locks had been settled as of December 31,

2005.

Cash and Cash Equivalents—Cash equivalents consist of short-term, highly liquid investments with maturities of three

months or less when purchased. Substantially all of our cash is on hand with one bank.

-53-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠