Frontier Airlines 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

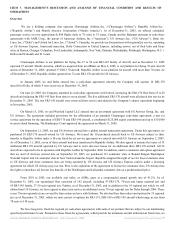

Risks Related To Our Common Stock

Our stock price is volatile.

Since our common stock began trading on The NASDAQ National Market on May 27, 2004, the market price of our common

stock has ranged from a low of $8.15 to a high of $16.85 per share. The market price of our common stock may continue to fluctuate

substantially due to a variety of factors, many of which are beyond our control, including:

• announcements concerning our code-share partners, competitors, the airline industry or the economy in general;

• strategic actions by us, our code-share partners or our competitors, such as acquisitions or restructurings;

• media reports and publications about the safety of our aircraft or the aircraft types we operate;

• new regulatory pronouncements and changes in regulatory guidelines;

• general and industry specific economic conditions;

• changes in financial estimates or recommendations by securities analysts;

• sales of our common stock or other actions by investors with significant shareholdings or our code-share partners; and

• general market conditions.

The stock markets in general have experienced substantial volatility that has often been unrelated to the operating

performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock.

In the past, stockholders have sometimes instituted securities class action litigation against companies following periods of

volatility in the market price of their securities. Any similar litigation against us could result in substantial costs, divert management's

attention and resources and harm our business.

Future sales of our common stock by our stockholders could depress the price of our common stock.

Sales of a large number of shares of our common stock, the availability of a large number of shares for sale, or sales of shares of our

common stock by Wexford Capital and/or its affiliates or Delta could adversely affect the market price of our common stock and

could impair our ability to raise funds in additional stock offerings. We have 41,837,685 shares of common stock outstanding as of

February 1, 2006. We are subject to an agreement with the underwriters of our last public offering that restricts our ability to sell or

transfer our stock until March 15, 2006. In addition, the selling stockholder and our directors and executive officers are subject to

agreements with the underwriters of our last public offering that restrict their ability to sell or transfer their stock until March 1, 2006,

with certain exceptions, including the ability of certain executive officers to sell up to 200,000 shares of common stock under their

existing 10b5-1 plans. Merrill Lynch & Co., on behalf of the underwriters, may, in its sole discretion and at any time, waive the

restrictions on transfer under these agreements during the applicable periods. After these agreements expire, all of these shares will be

eligible for sale in the public market.

-25-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠