Frontier Airlines 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

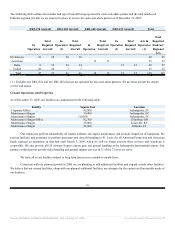

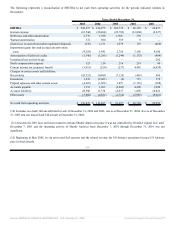

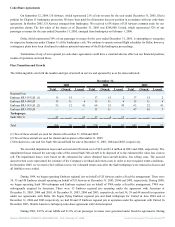

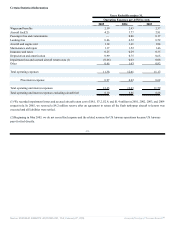

The following represents a reconciliation of EBITDA to net cash from operating activities for the periods indicated (dollars in

thousands):

Years Ended December 31,

2005 2004 2003 2002 2001

EBITDA $ 228,597 $ 126,275 $ 106,779 $ 42,129 $ 24,837

Interest expense (63,546) (28,464) (22,789) (12,868) (6,227)

Debt issue and other amortization 2,776 1,928 1,968 339 —

Warrant amortization 372 800 359 9 —

(Gain) loss on aircraft and other equipment disposals (276) 1,151 1,079 193 (460)

Impairment (gain) loss and accrued aircraft return

costs (4,218) 1,441 2,756 7,196 8,100

Amortization of deferred credits (1,346) (1,285) (1,249) (1,132) (889)

Unrealized loss on fuel swaps — — — — 202

Stock compensation expense 125 214 214 214 90

Current income tax (expense) benefit (1,915) (520) (237) 4,485 (6,659)

Changes in certain assets and liabilities:

Receivables (10,323) 10,480 (7,124) (481) 896

Inventories 1,276 (2,683) (2) 715 579

Prepaid expenses and other current assets (4,907) (1,022) 1,057 (1,116) (368)

Accounts payable 1,152 1,963 (4,405) 4,209 1,490

Accrued liabilities 28,980 11,370 14,937 1,805 10,826

Other assets (5,868) (4,821) (1,716) (2,987) (9,461)

Net cash from operating activities $ 170,879 $ 116,827 $ 91,627 $ 42,710 $ 22,956

(10) Excludes two Saab 340 aircraft held for sale at December 31, 2002 and 2003, one as of December 31, 2004, five as of December

31, 2005 and one leased Saab 340 aircraft at December 31, 2002.

(11) Amounts for 2001 have not been restated to include Shuttle America because it was not controlled by Wexford Capital LLC until

December 7, 2001 and the operating activity of Shuttle America from December 7, 2001 through December 31, 2001 was not

significant.

(12) Beginning in May 2005, we do not record fuel expense and the related revenue for US Airways operations because US Airways

pays for fuel directly.

-33-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠