Frontier Airlines 2005 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

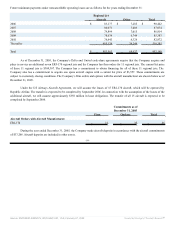

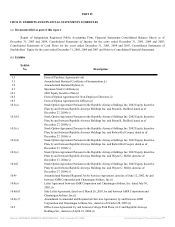

12. INCOME TAXES

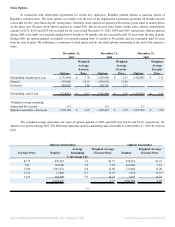

The components of the provision for income tax expense (benefit) for the years ended December 31 are as follows:

2005 2004 2003

Federal:

Deferred $ 32,855 $ 18,941 $ 19,812

32,855 18,941 19,812

State:

Current 1,915 520 237

Deferred 4,751 5,086 3,930

6,666 5,606 4,167

Income tax expense $ 39,521 $ 24,547 $ 23,979

A reconciliation of income tax expense at the applicable federal statutory income tax rate to the tax provision as reported for the years

ended December 31 are as follows:

2005 2004 2003

Federal income tax expense at statutory rate $ 35,163 $ 22,190 $ 21,041

State income tax expense, net of federal benefit 4,333 3,644 2,709

Other 25 (1,287) 229

Income tax expense $ 39,521 $ 24,547 $ 23,979

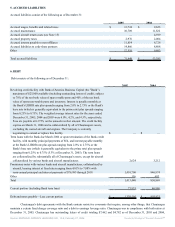

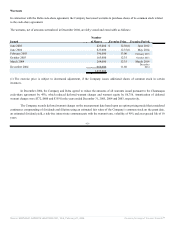

The components of deferred tax assets and liabilities as of December 31 are as follows:

2005 2004

DEFERRED TAX ASSETS

Current:

Nondeductible accruals $ 1,619 $ 4,553

Nondeductible accrued interest 1,351

Asset impairment expenses 1,463

Prepaid rent 574 524

3,656 6,428

Noncurrent:

Nondeductible reserves — 2,920

Nondeductible accruals 5,107 1,868

Treasury locks 2,989 2,793

Stock option benefit 1,922 —

Alternative minimum tax credit 457 457

Net operating loss carryforward 176,280 142,874

Prepaid rent 6,889 6,284

Deferred credits and sale leaseback gain 7,749 7,831

Total 201,393 165,027

Valuation allowance (8,119) (8,119)

193,274 156,908

Total assets 196,930 163,336

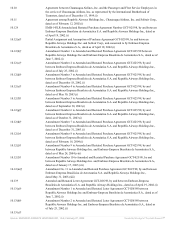

DEFERRED TAX LIABILITIES

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠