Frontier Airlines 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Warrants—Equity instruments issued to code-share partners are recorded on the measurement date as deferred charges and

credits to stockholders’ equity. Warrants surrendered in a nonmonetary transaction are recorded at fair value on the measurement date

as reductions to deferred warrant charges and stockholders’ equity. The deferred charges for warrants are amortized as a reduction of

passenger revenue over the terms of the code-share agreements.

Stock Compensation—The Company applies Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to

Employees, and related interpretations in accounting for stock options. No compensation expense is recorded for stock options with

exercise prices equal to or greater than the fair market value on the grant date. Warrants issued to non-employees are accounted for

under SFAS No. 123, Accounting for Stock-Based Compensation and EITF 96-18, Accounting for Equity Instruments That Are Issued

to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services, at fair value on the measurement date.

SFAS No. 148, Accounting for Stock-Based Compensation—Transition and Disclosure—an Amendment of FASB Statement

No. 123, Accounting for Stock-Based Compensation, requires disclosing the effects on net income available for common stockholders

and net income available for common stockholders per share under the fair value method for all outstanding and unvested stock

awards. SFAS No. 148 disclosure requirements, including the effect on net income available for common stockholders and net income

available for common stockholders per share, if the fair value based method had been applied to all outstanding and unvested stock

awards in each period, are as follows:

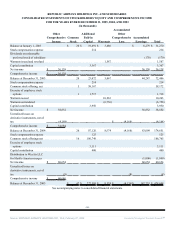

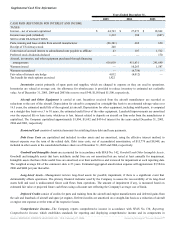

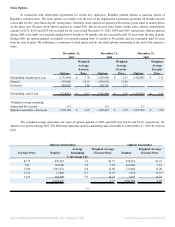

For the years ended December 31,

2005 2004 2003

Net income available for common stockholders, as reported $ 60,654 $ 38,852 $ 35,968

Add: Stock-based employee compensation expense determined

under the intrinsic value based method, net of tax 75 129 128

Deduct: Stock-based employee compensation expense

determined under the fair value based method, net of tax (1,496) (327) (338)

Pro forma net income available for common

Stockholders $ 59,233 $ 38,654 $ 35,758

Pro forma net income available for common stockholders per

share:

Basic $ 1.65 $ 1.66 $ 1.79

Diluted $ 1.62 $ 1.62 $ 1.72

The fair value of options granted were estimated on the date of the grant using the Black-Scholes option pricing model with

the following assumptions: no dividend yield; risk-free interest rates ranging from 2.0% to 6.70%; volatility of 40%-50%; and an

expected life ranging from 4 to 6.5 years. The pro forma amounts are not representative of the effects on reported earnings for future

years.

Net Income Available for Common Stockholders Per Share is based on the weighted average number of shares outstanding

during the period.

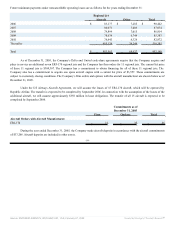

The following is a reconciliation of the weighted average common shares for the basic and diluted per share computations:

For the Years Ended December 31,

2005 2004 2003

Weighted-average common shares outstanding for basic net income

available for common stockholders per share 35,854,249 23,349,613 20,000,000

Effect of dilutive employee stock options 694,091 557,150 841,415

Adjusted weighted-average common shares outstanding and assumed

conversions for diluted net income available for common

stockholders per share

36,548,340 23,906,763 20,841,415

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠