Frontier Airlines 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

lease return costs, $1.3 million to reflect the write off of purchased route costs on markets that were abandoned and $0.2 million due to

the retirement of one owned Saab 340 aircraft. In 2003 this charge consisted of $2.1 million to reflect deterioration of the market value

for Saab turboprop aircraft and related spare parts and a reduction of $0.3 million to reflect the estimated liability for Saab 340 aircraft

lease return costs.

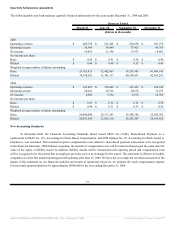

Other expenses increased 57.7%, or $17.4 million, to $47.5 million in 2004 from $30.1 million in 2003, due to an increase in

bad debt reserves (primarily attributable to obligations owed to us by US Airways), increased pilot training costs, and higher

crew-related and administrative expenses to support the growing regional jet operations. The unit cost increased to 1.0¢ in 2004

compared to 0.8¢ in 2003.

Interest expense increased 24.9% or $5.7 million, to $28.5 million in 2004 from $22.8 million in 2003 primarily due to

interest on debt related to the purchase of additional aircraft since the beginning of 2003. The weighted average interest rate was

unchanged at 5.2%. The unit cost remained unchanged at 0.6¢.

We incurred income tax expense of $24.5 million during 2004, compared to $24.0 million in 2003. The effective tax rates for

2004 and 2003 were 38.7% and 39.9%, respectively, which were higher than the statutory rate due to state income taxes and

non-deductible meals and entertainment expense, primarily for our flight crews.

-40-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠