Frontier Airlines 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

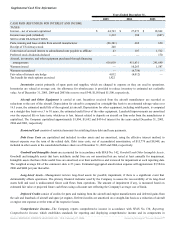

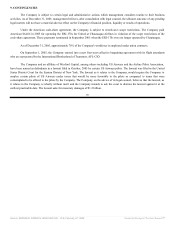

Employee stock options and warrants of 2,927,400 and 2,640,000 are not included in the calculation of diluted net income

available for common stockholder per share due to their anti-dilutive impact for the years ended December 31, 2004 and 2003,

respectively. For the year ended December 31, 2005 all of the employee stock options and warrants were included in the calculation of

diluted net income available for common stockholder per share.

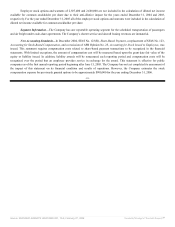

Segment Information—The Company has one reportable operating segment for the scheduled transportation of passengers

and air freight under code-share agreements. The Company’s charter service and aircraft leasing revenues are immaterial.

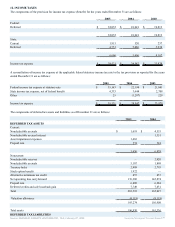

New Accounting Standards—In December 2004, SFAS No. 123(R), Share-Based Payment, a replacement of SFAS No. 123,

Accounting for Stock-Based Compensation, and a rescission of APB Opinion No. 25, Accounting for Stock Issued to Employees, was

issued. This statement requires compensation costs related to share-based payment transactions to be recognized in the financial

statements. With limited exceptions, the amount of compensation cost will be measured based upon the grant date fair value of the

equity or liability issued. In addition, liability awards will be remeasured each reporting period and compensation costs will be

recognized over the period that an employee provides service in exchange for the award. This statement is effective for public

companies as of the first annual reporting period beginning after June 15, 2005. The Company has not yet completed its assessment of

the impact of this statement on its financial condition and results of operations. However, the Company estimates the stock

compensation expense for previously granted options to be approximately $900,000 for the year ending December 31, 2006.

-55-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠